Moon Rabbit DeFi 2.0 Goes Live – An In-Depth Manual

Rolling Out the Moon Rabbit DeFi

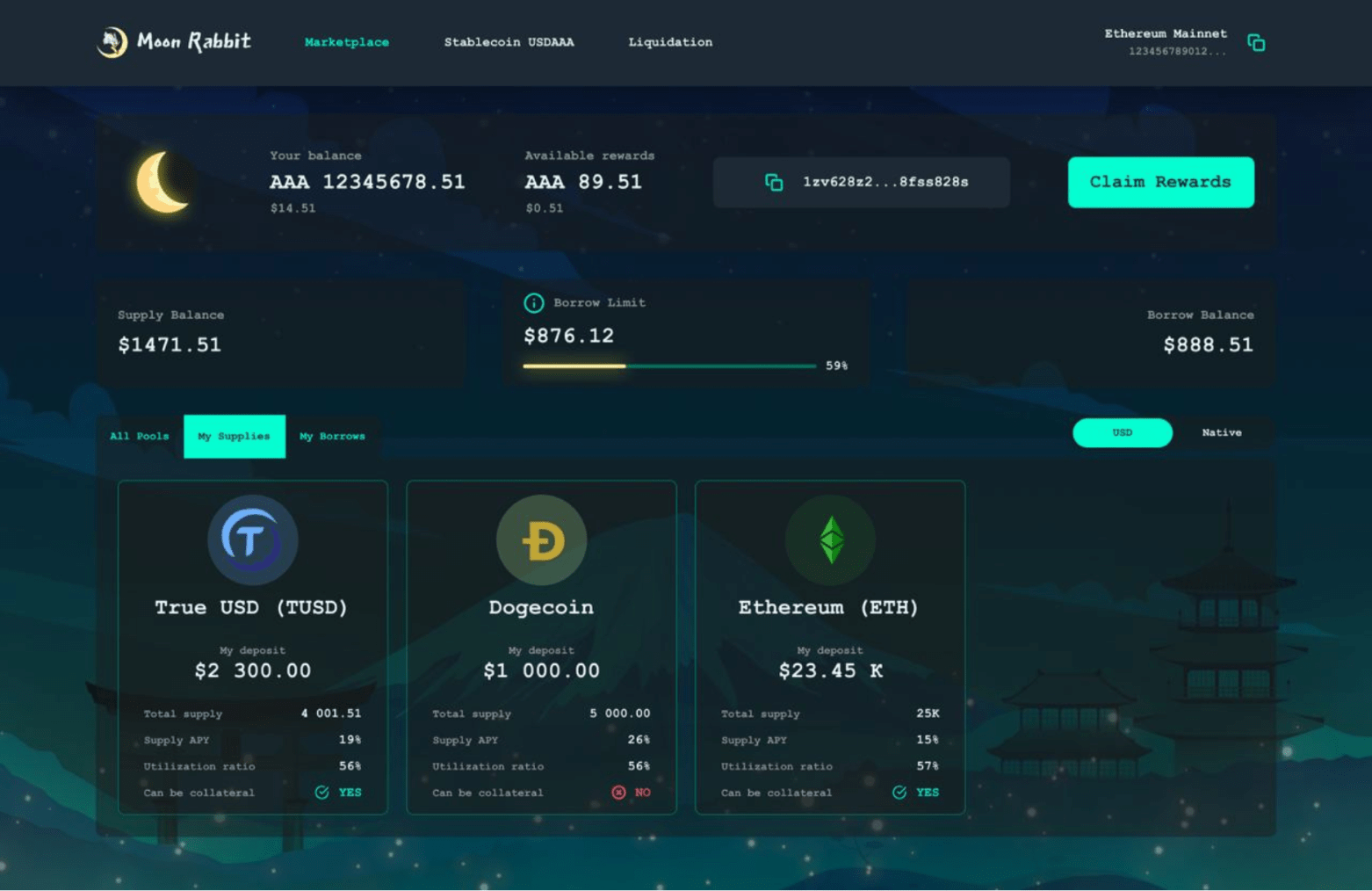

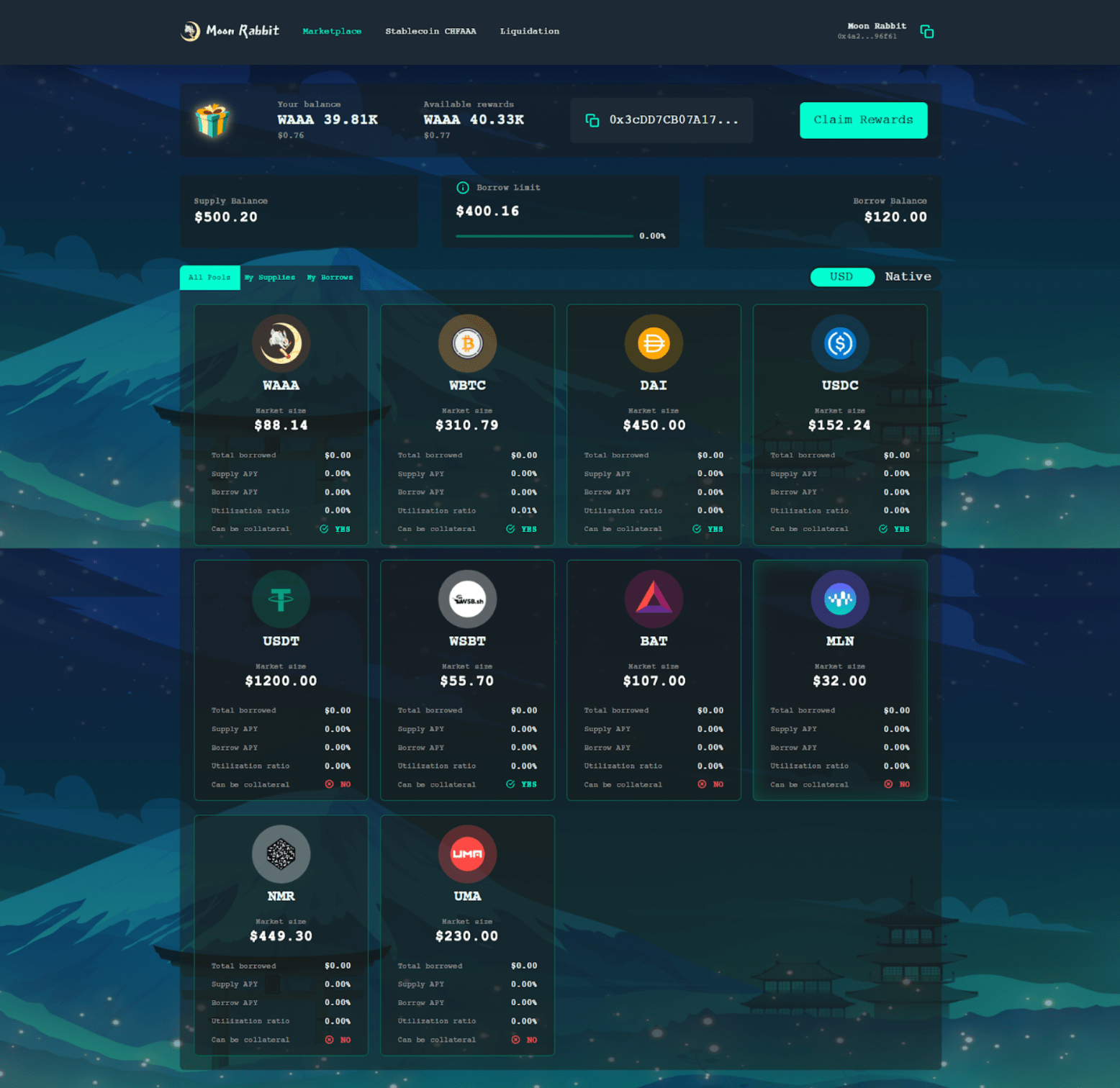

2022 has seen some crazy-busy months for Moon Rabbit, and August is poised to be no different. This month marks yet another milestone event for the ever-growing Moon Rabbit ecosystem – the Moon Rabbit DeFi 2.0 Jurisdiction. Chock-full of features and thoroughly audited, let’s take a dive and look closer at what exactly the latest Moon Rabbit offering has for us in store, and what possibly could set it apart from the competition. Read the blog for the overview of all the features and dive yourself into the platform at defi.moonrabbit.com

The protocol is more than ready to shake things up in the crowded DeFi space, boasting diverse trustless lending and borrowing functionalities, and at the same time featuring an innovative Adaptive Asset Pool Rewards system for all participating parties. Thanks to the Rust-based EVM Layer of Moon Rabbit, the platform not only flawlessly marries the concepts of security, familiarity and convenience, but also retains EVM compatible multichain interoperability, easily bridging the gap between the supplying assets on one chain and the borrowing ones on another. In a way, this allows the latest Moon Rabbit DeFi 2.0. Jurisdiction to act as a gateway to a world of decentralized finance, and perhaps more importantly – an easy entry point for a large user base that would have otherwise remained stuck at the back of a queue somewhere. This, especially, is something that, in time is meant to become a golden standard for all the protocols to come. And we are more than eager to lead the way.

Moon Rabbit DeFi 2.0 democratizes access to its protocols, which translates into instant participation. It also boldly shifts the status quo – granting users total freedom and control over their choices, all in a truly decentralized manner, and, obviously, as with everything Moon Rabbit, the transactions cost next to nothing. Furthermore, the platform is set to become a decentralized hub for multitude of tradable assets on the chain, which not only means full integration with other existing and upcoming products, both internal and external, but also bringing in a slew of new tokens on board to do just that. The platform aims to continue adding new pillars to its infrastructure on a regular basis and together with the recently announced DEX expand on what’s already possible on the chain – an all-in-one DeFi suite for minting, swapping, lending and borrowing in a fully trustless decentralized manner. Shortly after the launch, the platform will also extend its reach and seek out compatible dApps, from outside the ecosystem, maximizing the impact of a fully comprehensive and interactive DeFi cluster, that way rendering the existing solutions almost obsolete in comparison. This and more is just a taste of the direction our ecosystem is taking.

To celebrate this mammoth of an event, a special request has been sent to the Moon, and the AI-driven smart contract running the Jurisdiction back on Earth kindly ceded. And so, at the time of the launch, unique considerations will be made for anyone who decides to engage with the Protocol. Those will come in the form of generous APY boosts, and are planned to be further extended to involve all first-time interactions on the Lending side of the Jurisdiction. After a while, the bonuses will slowly normalize between more and more users and return to a regular rate, so don’t miss out. Early bird eats the worm! We welcome you all to participate in this boon, and let’s forge a new path for DeFi 2.0. Now, let’s dig into the meat of the Platform.

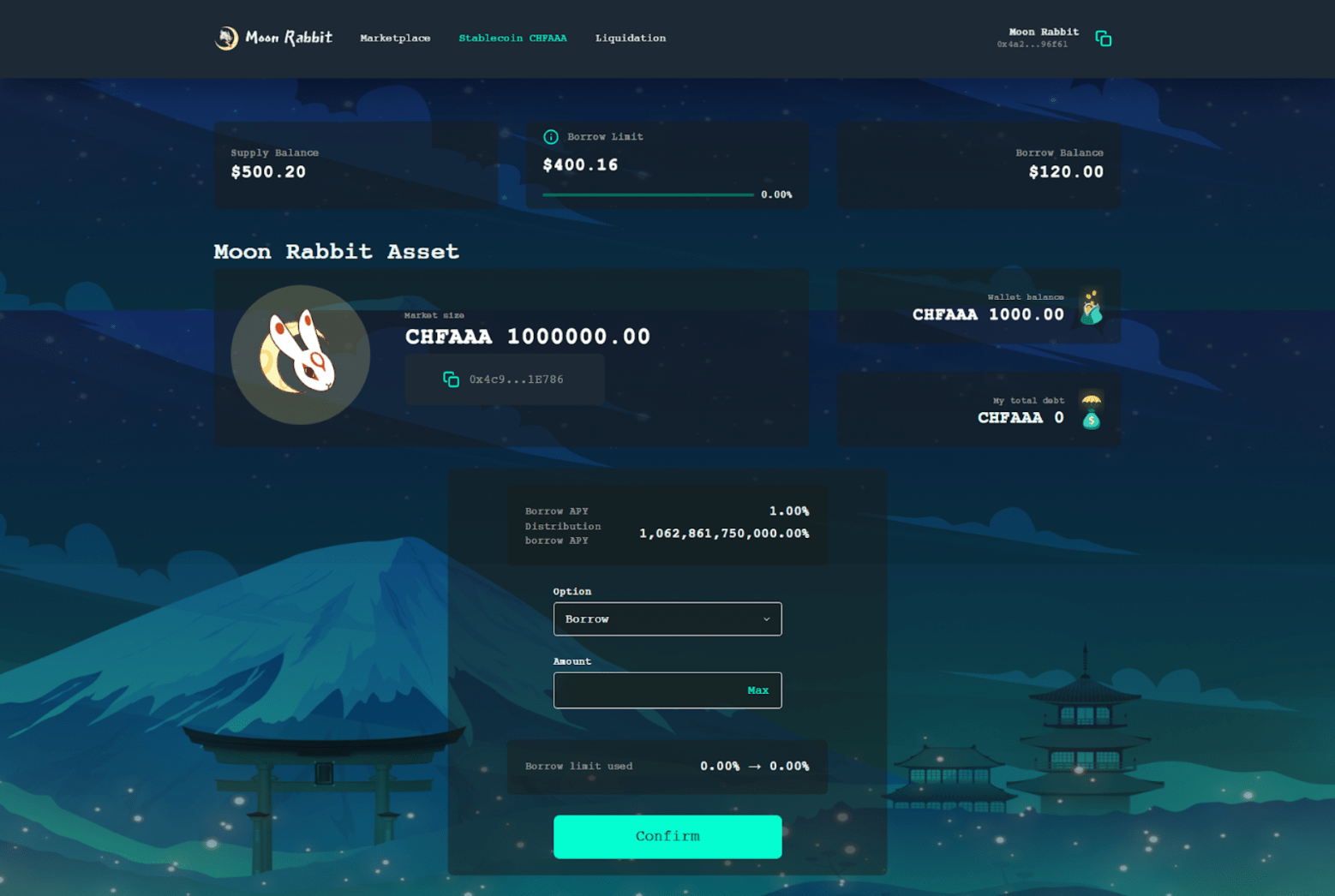

Firstly, our developer partners Web3 Foundation LLC have released the long-awaited synthetic stablecoin on chain, not one, but two. The detailed cryptoeconomic model for the stablecoins is going to be presented in a separate blog entry later in the month. There are two stablecoins so far, DAIAAA (a stablecoin reflecting synthetically the corresponding rate of DAI) and CHFAAA (a stablecoin reflecting synthetically the corresponding rate of CHF). As the time progresses, Web3 Foundation LLC may add further stablecoins to its offering. We encourage you to get acquainted with the legal terms of stablecoins and DeFi platform offered by Web3 Foundation LLC to fully understand the mechanics of their issuance. Any user on the platform would be able to mint and access stablecoins with their on-chain assets.

The Moon Rabbit DeFi 2.0 Jurisdiction will enable users to take trustless loans, simply by providing one asset as collateral and borrowing another one, all at a fixed interest rate and irrespective of the CHFAAA issued. Conversely, lenders will be able to add liquidity to the pools and enjoy an attractive interest on their capital allocated dynamically each second.

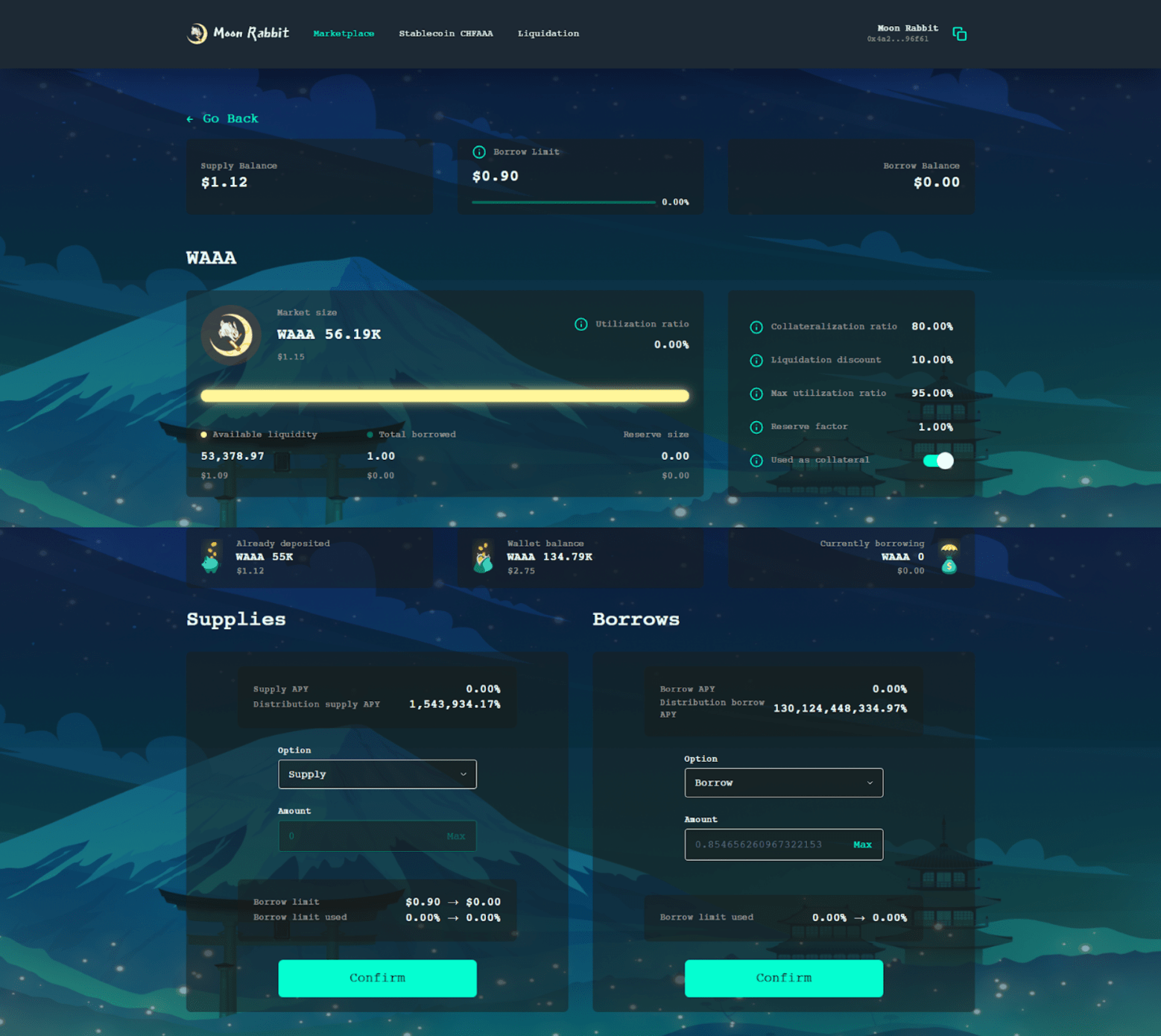

Adding Liquidity on the protocol, or to put it plainly – lending, is as simple as making a deposit. In return, users obtain AAA20, interest-bearing (IB) tokens, and thanks to the per-second rate accumulation – as opposed to per-block accumulation used by other protocols, such as Compound or AAVE, attain very high accuracy of interest rate calculation. Thus, Moon Rabbit 2.0 Jurisdiction is one of the most accurate DeFi platforms in the world in terms of distribution of rewards, ahead of major rivals.

These continuous tokens are characterized by Limitless Supply, Continuous and Deterministic Price, where the price is constantly being calculated and is defined by a bonding curve – which acts as an automated market maker, and finally, Instant Liquidity, allowing users to buy and sell instantaneously at any time. The lenders are free to exchange back the interest-bearing tokens for the ones they originally deposited, and can do that at any time, which is not always the case inside other protocols. Owing to the steady increase in the price of IB tokens, the lenders earn interest in the process.

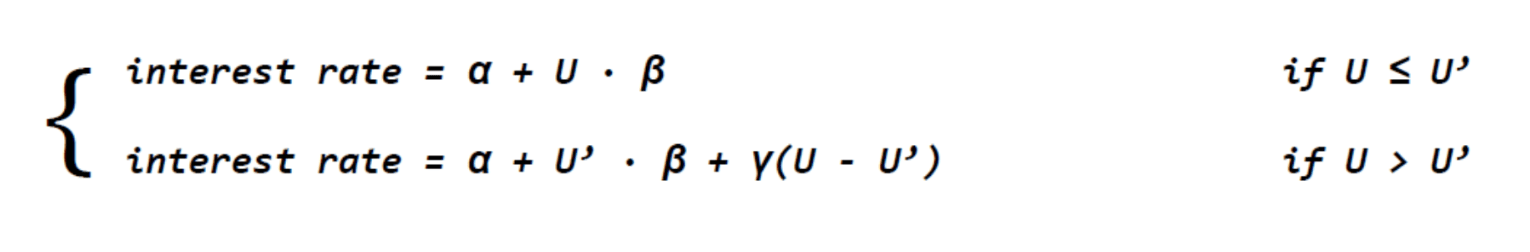

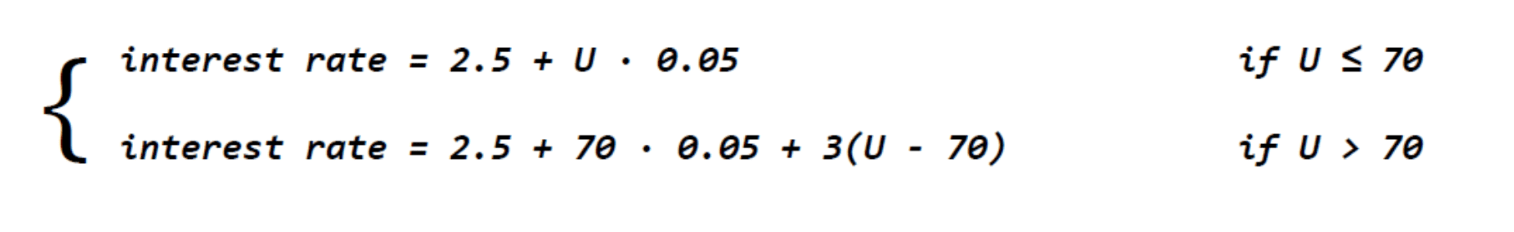

Moon Rabbit DeFi’s interest rate algorithm is designed not only to manage liquidity risk but also optimize utilization, and the value of the interest is based on the supply and demand that are presented as a utilization ratio value (U), following a simple formula:

The interest rate model itself uses kinked rates, where the rate sharply changes at a pre-defined threshold. In short this means that as more people are willing to borrow a particular asset, the smart contract increases the interest rate on it, which in turn makes the borrowing more expensive, and the high interest rates potentially help attract new lenders.

Function characterizing the interest rate:

Example on how the interest rate changes at different values:

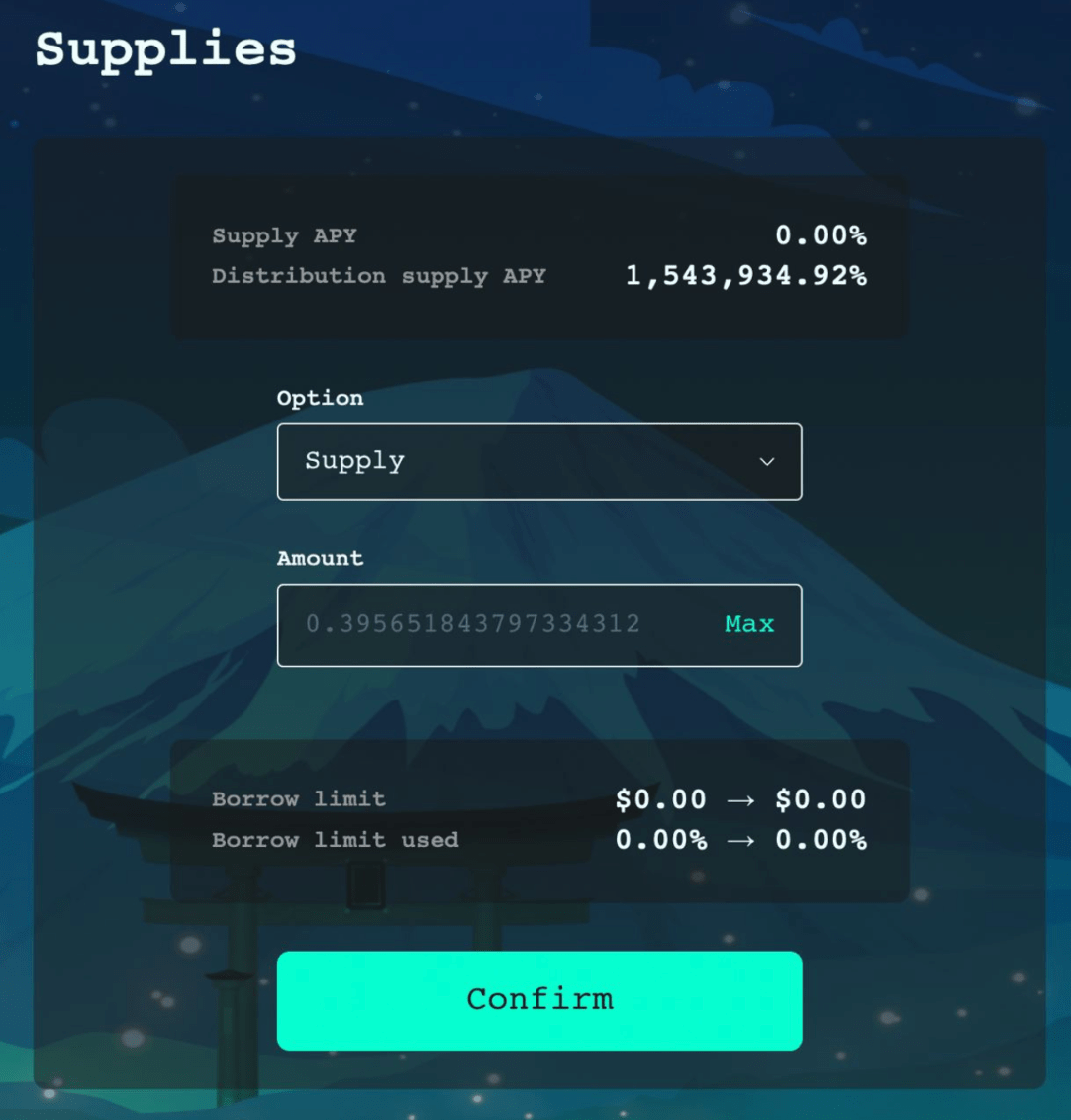

Lending different assets presents different opportunities to earn, and the lending APY can vary between tokens. The following table shows the Target Supply APY for different tokens:

| Target Supply APY, % | Token(s) |

| 55% | wAAA |

| 44% | WSBT |

| 33% | wBTC, DAI, USDT, USDC, ETH, BNB, BAT, MLN, NMR, UMA |

Note that target APY pertains to the ultimate target. Initial users and stakers on the platform are able to enjoy much higher rewards. As the APY curve is dynamic, the first few users for each pool may enjoy massive amounts of percent of APY until the pool grows to its target rate. For example the first lucky user to grab their spot in the AAA liquidity mining pool will enjoy a massive 1.5 million % APY, which will drop exponentially with each new participant in the pool until the target rate of 55% APY is reached. Initial few users will enjoy massively generous awards.

In sharp contrast to the above, Fantom DeFi provides users with a only 4% APY on deposits that can be withdrawn at any time, and this increases by a modest 10% – up to 14%, for users who decide to lock up their tokens for an entire year. APYs in that range seem to be a running theme in most of similar products on the market. With Moon Rabbit DeFi, not only are the APY rewards more attractive by default, but the users are free to exchange their tokens back at any time without compromising neither their profits nor their ability to earn. While the current reward distribution system lasts, this makes Moon Rabbit DeFi 2.0 Jurisdiction the most attractive platform in terms of APY and liquidity mining efficiency.

And finally for interest rates, but certainly not least importantly, the Platform utilizes a unique interest rate accumulation mechanism, and as we mentioned before, it’s quite different from mechanisms implemented in platforms like Compound or AAVE. Unlike those systems, Moon Rabbit DeFi Core calculates interest rate not per-the-block, but rather per-second, merging the demand for a much higher accuracy of interest rate calculation with another layer of transparency.

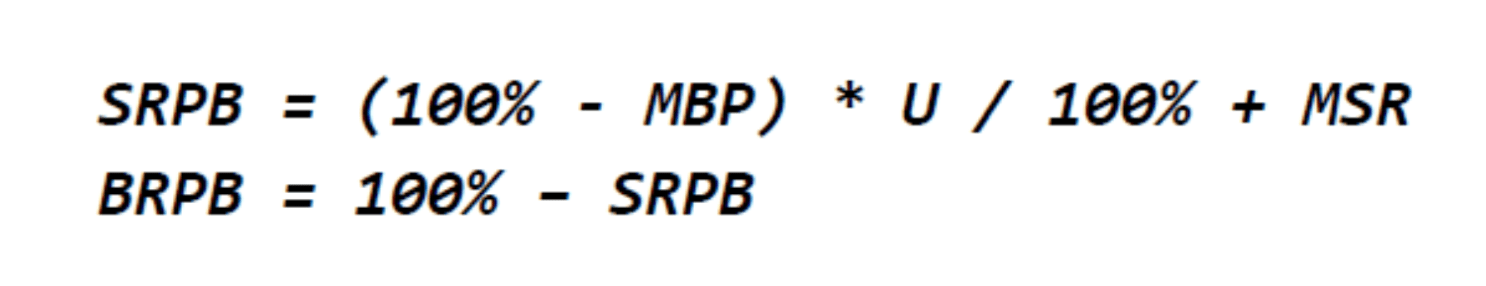

Apart from interest rates that the lenders obtain, all users participating also receive additional rewards in platform tokens for both lending and borrowing. This is accomplished through a system of Adaptive Asset Pool Rewards. The customizable nature of the protocols allows the owners to adjust the rewards per one block, even differently for each pool, and then have these values distributed between both lenders and borrowers. Platform tokens are minted once by the protocol owner and their supply is finite.

It might be helpful to think of it in the following way:

– When liquidity is available: borrowers are incentivized by rewards for borrowing

– When liquidity is scarce: lenders are incentivized with rewards for depositing funds

The formula of Adaptive Asset Pool Rewards looks as follows:

The platform also features a special safeguard, one designed specifically for scenarios where the collateral asset price falls and the debt starts exceeding that price. A situation like this is also why, initially, users cannot borrow more than the amount of collateral multiplied by Collateralization Ratio. Collateralization Ratio, or CR, defines how much CHFAAA is allowed by the protocol to be issued before liquidation of undercollateralized position happens.

Regardless, in such a case, a special mode called Liquidation comes into play. Liquidation starts when Liquidation Threshold has been reached and it leads to a part of the outstanding borrowing being repaid from sold collateral. The user’s IB tokens are exchanged for a token at the market price, but with a special 8% liquidation discount. The mechanism insulates the Jurisdiction from the risk of being left with a depreciated currency and ensures it always has the means to return the funds to the respective depositors. The number of funds that can be liquidated cannot exceed 50%.

In a fashion similar to a lot of other features the Platform boasts, like Reserve Factor and the mentioned earlier Reward per Block, Liquidation Threshold is an easily customizable parameter of the Protocol, and Liquidation itself can be initiated by any user, shifting even more power and freedom into the hands of the ecosystem participants.

The platform supports algorithmic stablecoins – CHFAAA stable coin synthetically linked to Swiss Franc and DAIAAA stablecoin synthetically linked to DAI, with a set of reliable assets for use as collateral for its issuance. The support will soon grow to include integration with other stable coins, like USDT, USDC or BUSD. That selection, coupled with the highly customizable parameters of the Protocol, aims to provide a rich, user-first environment, and an experience yet unmatched by any existing platform.

As we have already pointed out at the beginning of the article, the Platform has been thoroughly audited and passed that test with flying colors. The scope of the audit consisted of 39 contracts, interfaces and libraries. During the course of the audit, all the initially identified minor issues were promptly fixed, most of them were of optimization nature, and none of them are present in the final version of the contracts – not only drastically improving on the security, but also leaving the latest Jurisdiction free to blaze fresh DeFi trails. We welcome you all to read more about the audit and its findings in our previous blog entry – Moon Rabbit DeFi 2.0 Jurisdiction Passes Ambisafe Security Audit.

With the Ethereum Virtual Machine’s technological advancements at the forefront, the new Jurisdiction aims to challenge the top players in the DeFi scene. Already, the platform’s current capabilities are at levels of the likes of Avalanche and Fantom, and de-facto leagues above many others in the field.

Once again Moon Rabbit has shown hard at work making its ecosystem the place to be for both the existing community and newcomers alike. A uniquely qualified and competent DeFi project is a natural extension and perfect fit for the budding ecosystem, and yet another stellar example of a long term vision coming to life.

We are excited to open this new chapter in the development of Moon Rabbit ecosystem and are looking forward to your feedback about this journey! Drop us a line on Telegram, Discord and other social media. Stay tuned for other releases and updates later this month!