Moon Rabbit Metachain

unlocks DeFi 2.0

While the first generation of DeFi dapps and protocols exploded in 2020, many projects have since hit various liquidity challenges and limits to scaling, bringing the DeFi segment of crypto into a relative bear market. Rethinking and redesigning of many concepts and architectures underlying DeFi became necessary. While DeFi itself is a multi-trillion-dollar opportunity, it is presently crippled by the siloing of liquidity and financial transactions between Ethereum and its various roll-ups and Layer2s as well as other Layer1 contenders Solana, Avalanche and BSC.

Moon Rabbit’s Substrate-based Metachain is a Layer0 by design, and it permits massively scalable cross-chain interaction between various independent Layer1s. Thanks to our Metabridge we already have a gateway for transfer of fungible and non-fungible tokens between EVM Networks. The next step for us is to launch cross-chain liquidity protocols between our Jurisdictions to maximise yield efficiency on idle capital by connecting to opportunities between different chains.

Our DeFi 2.0 vertical will be a Substrate-based Jurisdiction and will initially consist of basic trustless primitives: Borrowing, Depositing/Lending, Stablecoin, Oracles, Swapping, Farming. They will be the foundation blocks upon which additional elements, together with other existing web3 primitives of Moon Rabbit, can be built, such as Rad Rabbit NFT backed loans, credit delegation for higher yield on in-game items in the Bunniverse, multi-purpose DAOs and a decentralised exchange. Depending on the progress of the independent DEX projects Rabbitswap and Rabbitex, we will either integrate the DeFi 2.0 vertical with these projects, or launch our own DEX to facilitate liquidity pools necessary for functioning of stablecoins and other components.

We are launching our DeFi 2.0 Jurisdiction in stages over Q1 2022. The initial liquidity distribution for the DeFi 2.0 Jurisdiction amounts to 8,888,888,888 AAA. Among others, the liquidity will bootstrap initial activities of stablecoin, lending protocols, decentralised exchange and DAOs. We are eager to work with founders of existing or upcoming DeFi protocol and DAOs who will either launch their product on Moon Rabbit or port it to our ecosystem. Trustless liquidity pools may be allocated to any project strengthening our DeFi 2.0 suite.

Additionally, to expand the connectivity of our network and to address the excessive gas fees on Ethereum Main-Net that have prevented many community members from participating in our NFT ecosystem and marketplace, we will be launching AAA on Polygon and BSC and will also connect Moon Rabbit EVM to those networks via our Metabridge. This will permit users to transfer their tokens between much cheaper. Our community partners will also encourage exchanges that currently support AAA to offer withdrawal options on Moon Rabbit EVM as well as BSC and Polygon. We welcome any additional feedback and suggestions from the community on improving our cross-chain functionality.

Lastly, we are engaging cybersecurity and pen-tester experts to stress-test our bridges and DeFi infrastructur and we offer bug bounty of up to $100k paid in $AAA. Reach out to us to find out more about this.

Below we go deeper into some of the individual components of DeFi 2.0 on Moon Rabbit:

Lending and Borrowing

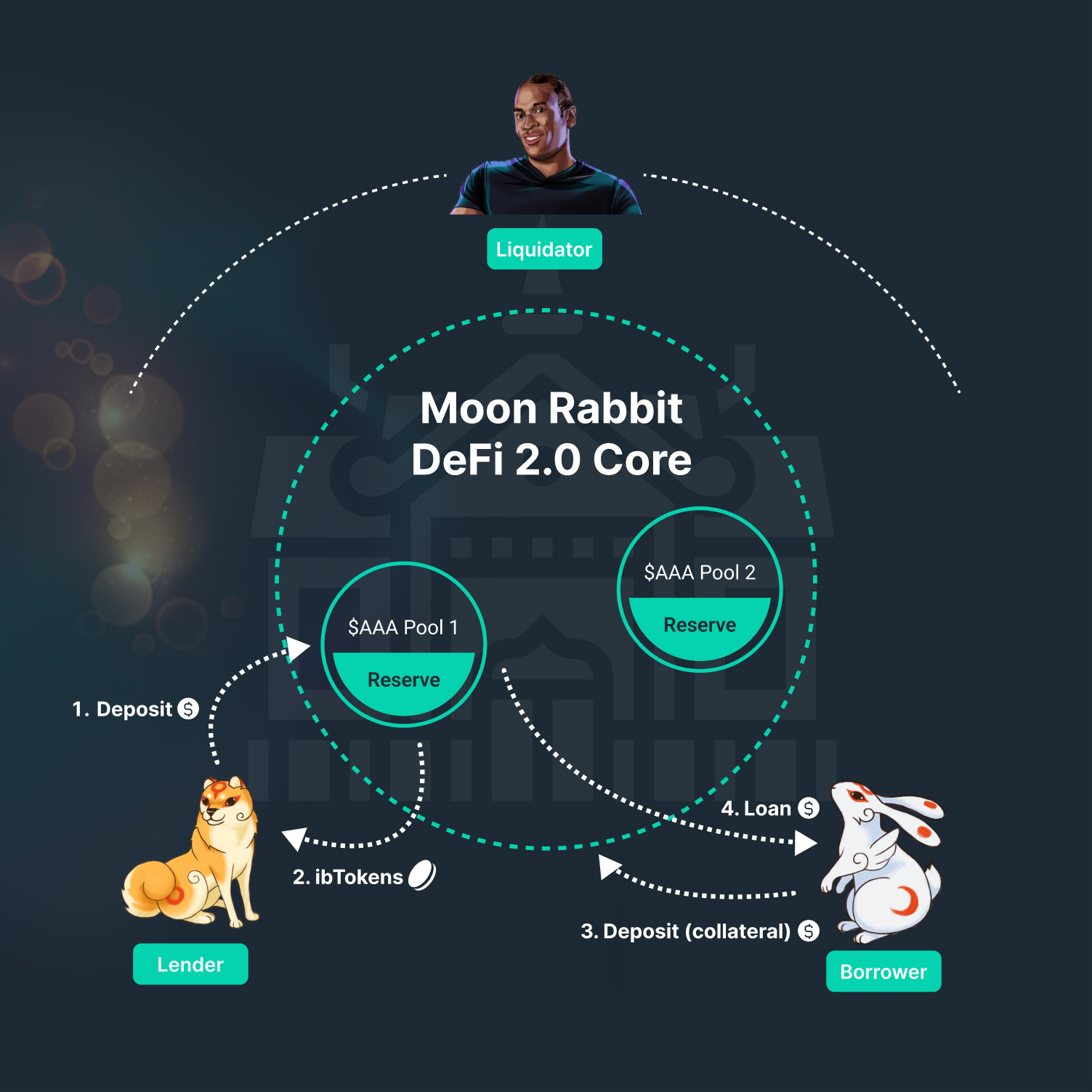

Within the Protocol, we have two main processes:

Adding liquidity (depositing/lending) — The lender deposits the desired amount of AAA or any other token and, as a result, obtains interest-bearing tokens – ibAAA. Then, at any time, the lender can exchange them for their initial AAA tokens. Because of the constant growth of the ibAAA token price, the lender will also obtain the interest rate.

Taking a loan (borrowing). Borrower leaves one asset as a collateral and borrows another one. Initially, while borrowing, the user can not borrow an amount greater than the amount of collateral multiplied by a coefficient (CR). If the collateral asset prices falls, the price of the debt reaches and ultimately exceeds the price of the collateral. In this case a liquidation threshold triggers the liquidation process, with the collateral being sold on the market at a discount. This mechanism keeps the protocol from the risk of being left with a depreciated currency and being unable to return the funds to the depositors.

Adaptive Asset Pool Rewards.

Apart from the interest rate that the liquidity providers obtain, each user receives rewards in AAA for lending and borrowing. Administrators of pools and, later, DAOs can set a different value of reward per one block for each pool, distributing this value between lenders and borrowers. Later on, mathematical dependencies manifest themselves in the following way, in order to bring the protocol to the equilibrium:

- When liquidity is available: borrowers are incentivized by rewards for borrowing;

- When liquidity is scarce: lenders are incentivized with rewards for depositing funds.

Stablecoin

Our DeFi 2.0 will be powered by a stablecoin, but it will not be pegged to the US Dollar. The coronavirus crisis has clearly demonstrated that the US Dollar is not a stable currency, with the official inflation rate being 7%, while many real economy assets necessary for consumers and business owners have grown at a double digit rate. Moreover, the industry’s willingness to leave the whole stablecoin ecosystem vulnerable to the whims of the Federal Reserve and American politics is highly ironic given the quest for supranationality, llibertarianism and decentralisation enshrined into the core of the crypto community.

We are still doing research on a suitable construct for a stablecoin and we acknowledge the very low diversity of assets tracked by oracles that could be used in our system without creating a systemic risk within our ecosystem from excessive advernturousness and experimentation. We will confirm the final concept for pegging our stablecoin in due course, once we consult additional interested stakeholders. At the very minimum, a viable alternative for our first stablecoin could be pegging our stablecoin value to a stable fiat currency of a highly developed neutral country whose purchasing power has remained strong through multiple crises and is trusted by both its native population as well as a sizeable part of an international community, such as the Swiss Franc (CHF).

Below is an illustrative example that is used to simplify the understanding of the process of stablecoin issuance envisioned on Moon Rabbit DeFi 2.0. It should not, however, be construed as a legally binding description. The stablecoin is intended to be decentralised, without a particular party against whom a claim can be made.

To issue a collateralised CHFAAA stablecoin pegged to CHF, the following mechanics will be used by the Protocol:

- Moon Rabbit DeFi 2.0 Jurisdiction has a set of approved assets which are accepted to be used as a collateral for the issuance of CHFAAA

- Each asset used as collateral has a specific Collateralization Ratio (CR) which defines how much CHFAAA is allowed by the protocol to be issued before liquidation of undercollateralized position will happen. For example, if CR is set to 150% it means that for 150 CHF worth of collateral no more than 100 CHFAAA is allowed to be issued. For widely accepted assets like wBTC, BAT and SYS the CR may be set to 130-140%, for other stablecoins like DAI the CR is lower and could be less than 110%, while for exotic and volatile cryptocurrencies, the CR can exceed 180%.

- Any user who has deposited collateral assets to the Protocol can borrow CHFAAA. Borrowing means minting CHFAAA by the Protocol. The interest rate called Stability Rate (SR) for this loan is fixed and does not depend on CHFAAA issued. When the protocol governance stimulates stablecoin issuance, SR = 0%; conversely, when the intent is to reduce the amount of CHFAAA in circulation, there is an increase of SR.

- As soon as the loan is repaid partly or in full, DeFi 2.0 Protocol burns the payment of CHFAAA and reduces the amount of stablecoins in circulation.

- In case of market turbulence when Collateralization Ratio falls below accepted threshold, liquidation is triggered by any third party user who repays the CHFAAA loan and gets collateral with a 7-10% discount. This ensures there are always financial incentives for last-resort liquidity providers in the system.

Oracles

For reliable operations of our infrastructure with the accurate and timely supply of information about prices of items and other off-chain data, we have agreed to integrate Chainlink into Moon Rabbit EVM framework. The integration is now complete and provides protection from AMM asset pairs manipulation. Further communications on this matter will be provided by the Chainlink official channel in due course.

We are also building our in-house capabilities for oracles and are open to collaboration with other emerging projects offering oracle services to integrate natively on Moon Rabbit. Various financial incentives are available.

Proposed Extensions

We already have various extensions proposed. We encourage our community members with relevant skills to contribute to our code-base in exchange for rewards. Otherwise, the team is scaling its resources to continue building all the verticals of Moon Rabbit. The next proposed extensions to be used in the follow-up iteration of our DeFi suite are:

- Protocol for Credit Delegation and borrowing on behalf of depositors for higher yields, within the same chain and across multiple chains;

- Accepting ERC-721 and ERC-1155 NFTs as collateral to borrow ERC-20 tokens based on NFT Floor Price Oracle, connected to Moon Rabbit NFT Marketplace or OpenSea;

- Lending Protocol expansion to a UniSwap-like environment with open access for anyone to list tokens on the platform with standard parameters and permit trading and staking.

Competitive Advantage of Moon Rabbit DeFi 2.0

Besides the general advantages of the Architecture of Moon Rabbit, which is described in detail on our home-page and within the Cryptoeconomic Paper, the DeFi 2.0 Suite offers distinct protocol design advantages:

- High accuracy of interest rate calculation due to per-second rate compounding (as opposed to per block compounding used by existing protocols);

- Easily customisable protocol parameters such as liquidation threshold, reserve factor, reward per block, etc. – which opens up efficient DeFi management and customisation for DAOs that could become crucial stakeholders for Moon Rabbit DeFi ecosystem;

- Adaptive asset pool rewards to maximise capital efficiency;

- Modularity of Smart contracts makes them easily upgradeable.

We are excited about the future of web3 and Moon Rabbit’s protocols and verticals are here to onboard the next billion users into crypto. Stay tuned as we will share similar updates about our other verticals such as NFT, Metaverse and Longevity in the future! If you have any proposals or projects, share them with our community on one of our social media channels. Multiple bounty pools in $AAA are available for builders of exciting products and protocols for Moon Rabbit!