Moon Rabbit 2025 Roadmap: Major Upgrades, EVM & Memecoins

As we move forward into 2025, Moon Rabbit is preparing for a series of major upgrades aimed at strengthening our ecosystem, enhancing user experience, and ensuring that our infrastructure remains at the forefront of blockchain innovation. This roadmap outlines our key initiatives for the year, including a full upgrade of our Polkadot-based core, enhancements to the Moon Rabbit EVM, a crucial ChainID change, a broad infrastructure overhaul, and the launch of a dedicated memecoin platform.

Upgrading Moon Rabbit’s Polkadot Core and EVM

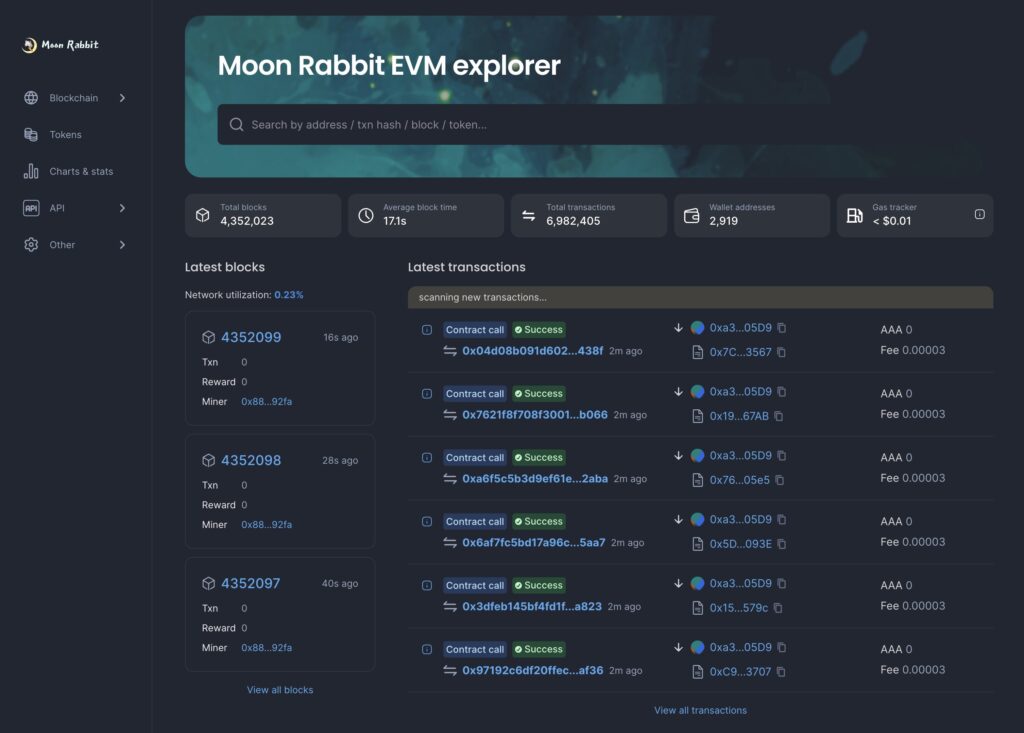

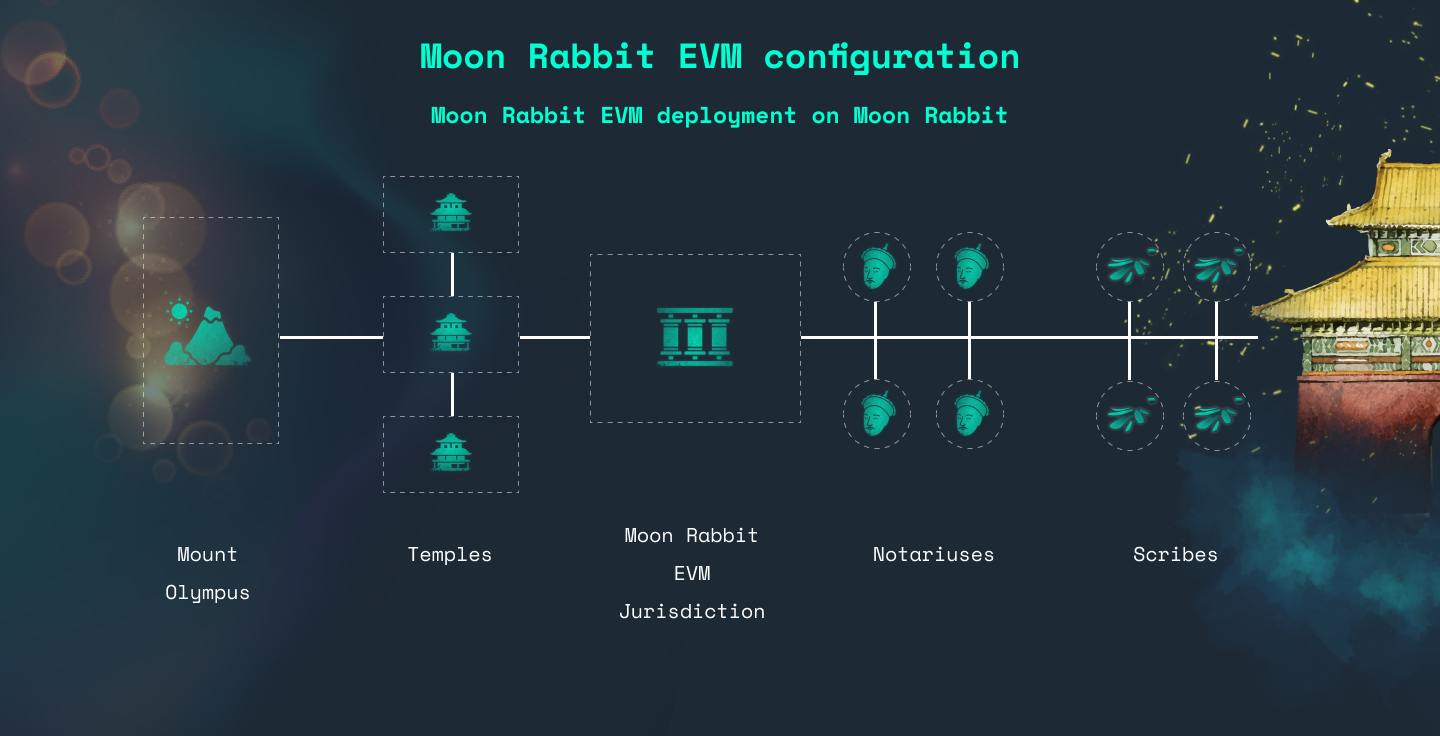

One of the biggest developments planned for 2025 is the full-scale upgrade of Moon Rabbit’s Polkadot core infrastructure and its EVM (Moonbeam-based) environment. With blockchain technology evolving rapidly, we aim to integrate the latest advancements to ensure that Moon Rabbit remains scalable, interoperable, and secure.

The upgrade will focus on:

- Enhancing performance and efficiency to support higher transaction throughput and faster finality.

- Improving cross-chain interoperability, ensuring seamless integration with other major blockchain networks.

- Strengthening security features, reinforcing network resilience against potential threats.

- Optimizing smart contract execution, allowing developers to deploy more complex dApps with reduced costs.

By aligning our Polkadot core and EVM with modern blockchain standards, we are setting the foundation for long-term sustainability and growth.

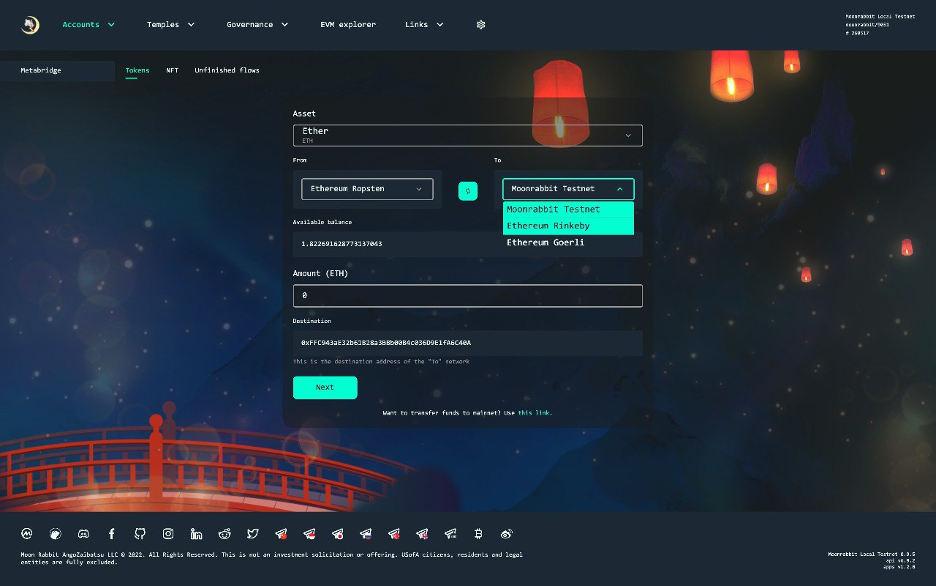

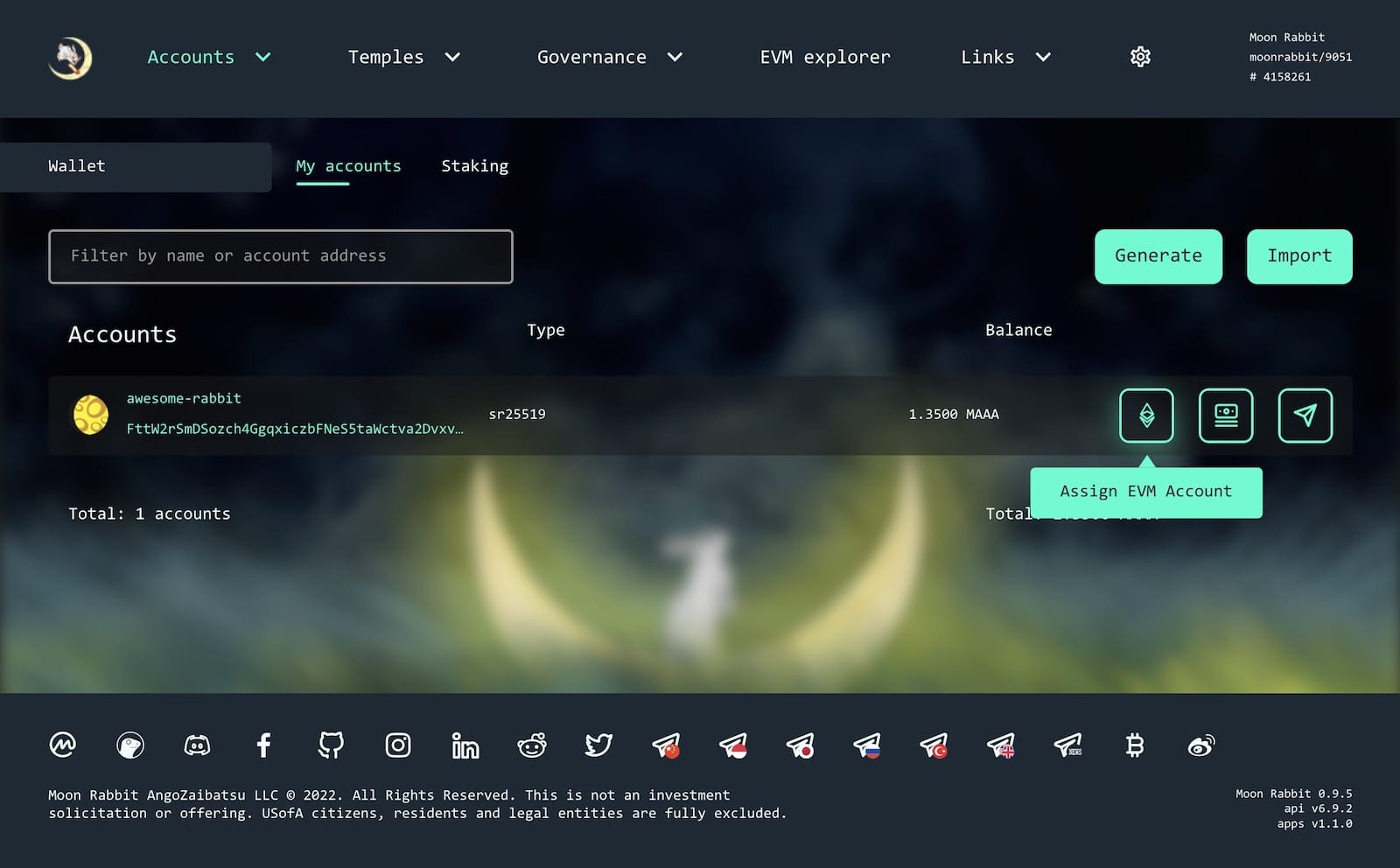

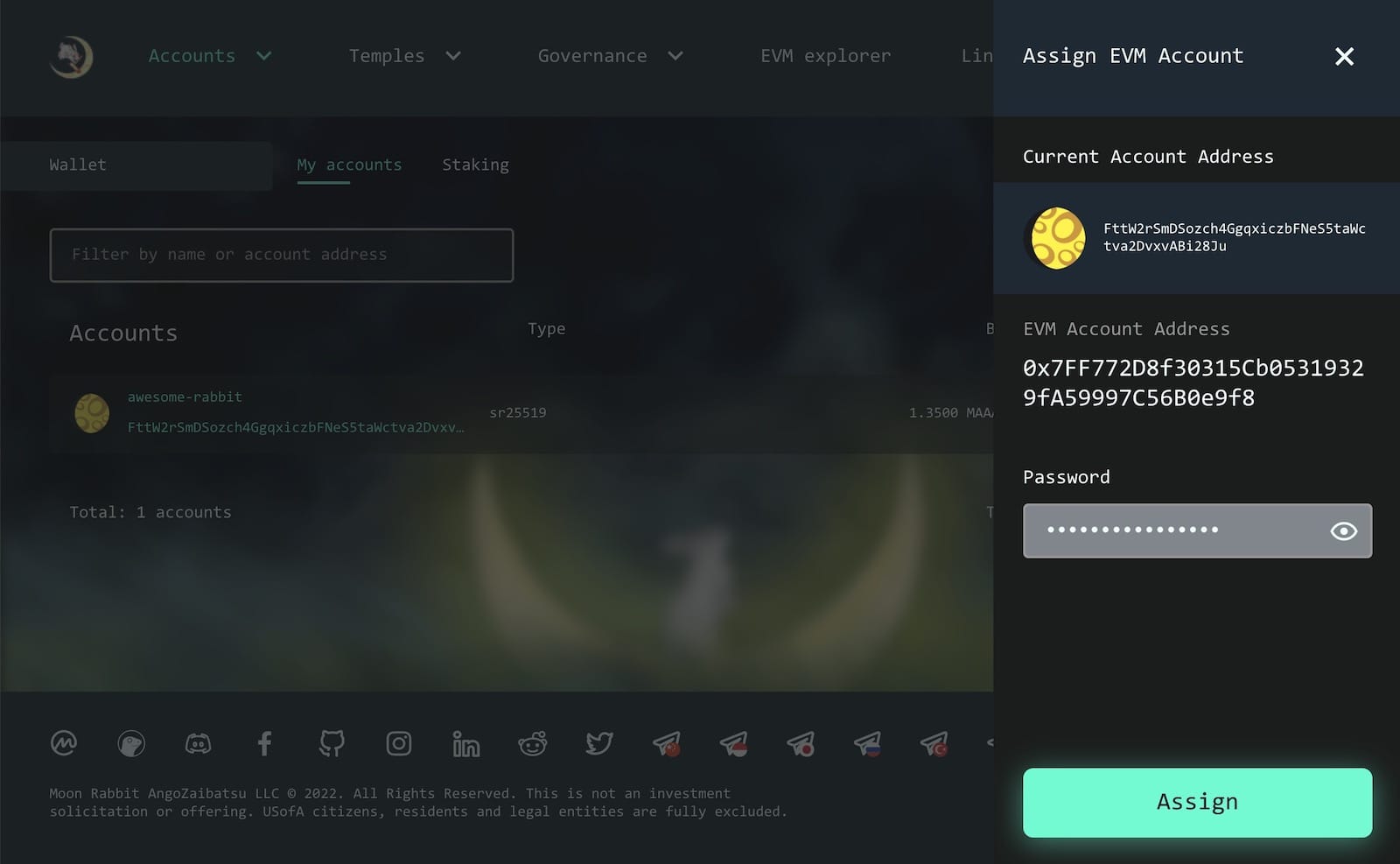

Fixing ChainID Conflict: Resolving the MetaMask Warning

A necessary technical improvement for 2025 is the change of Moon Rabbit EVM’s ChainID from 1280 to a new, conflict-free ChainID. This change is essential to resolving the MetaMask warning that currently states:

“According to our records, the network name may not correctly match this chain ID.”

This issue arose due to the early launch of Moon Rabbit EVM, before ChainList became the widely accepted registry for blockchain networks. At that time, ChainID 1280 was unclaimed, but over the years, it has been assigned to another project, creating an identity conflict. To address this, we are planning a smooth transition to a new ChainID, ensuring full compatibility with wallets like MetaMask and other Web3 tools.

This change will:

- Eliminate MetaMask warnings, improving the user experience for developers and token holders.

- Ensure seamless network recognition across dApps, wallets, and exchanges.

- Prevent potential future conflicts by adopting a properly registered ChainID.

- Ensure the safety of new users joining the Ecosystem.

We will provide a detailed migration guide for all developers and users well ahead of the switch to ensure a seamless transition.

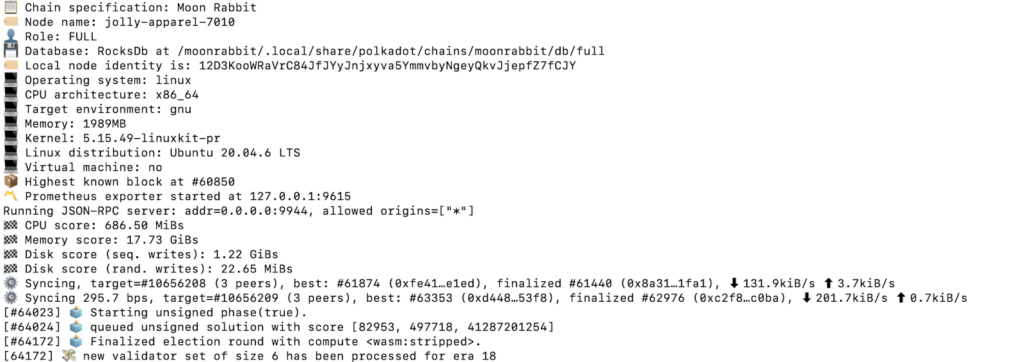

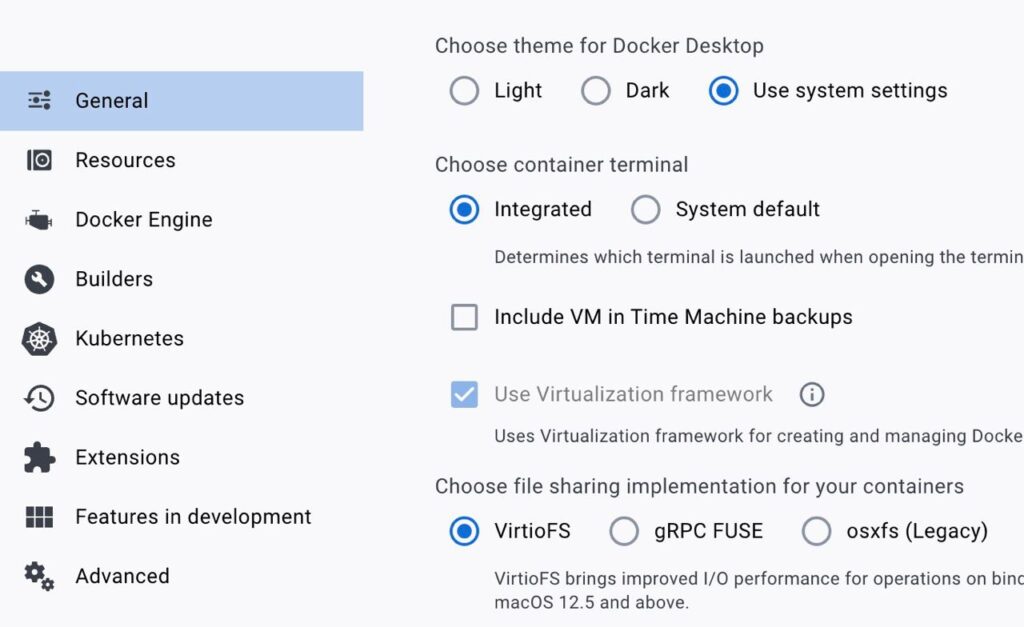

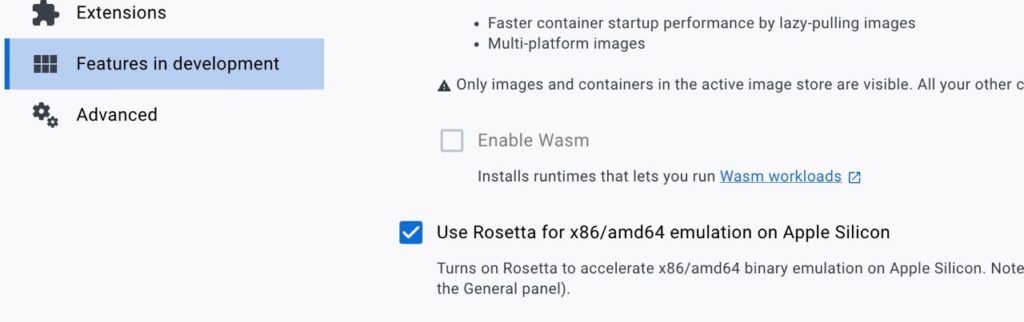

Infrastructure Overhaul: Meeting Modern Blockchain Standards

To keep Moon Rabbit fast, secure, and future-proof, we are undertaking a major infrastructure upgrade. This will bring Moon Rabbit in line with the latest blockchain requirements, including:

- More decentralized node distribution, ensuring higher network reliability and security.

- Optimized database management for faster blockchain syncing and better scalability.

- Enhanced smart contract execution for more efficient gas usage.

- Integration of advanced developer tools, making it easier for builders to deploy and interact with smart contracts.

These improvements will not only benefit existing dApps and projects within Moon Rabbit but will also attract new developers looking for a stable and powerful platform to build on.

Moon Rabbit Memecoin Launch Platform

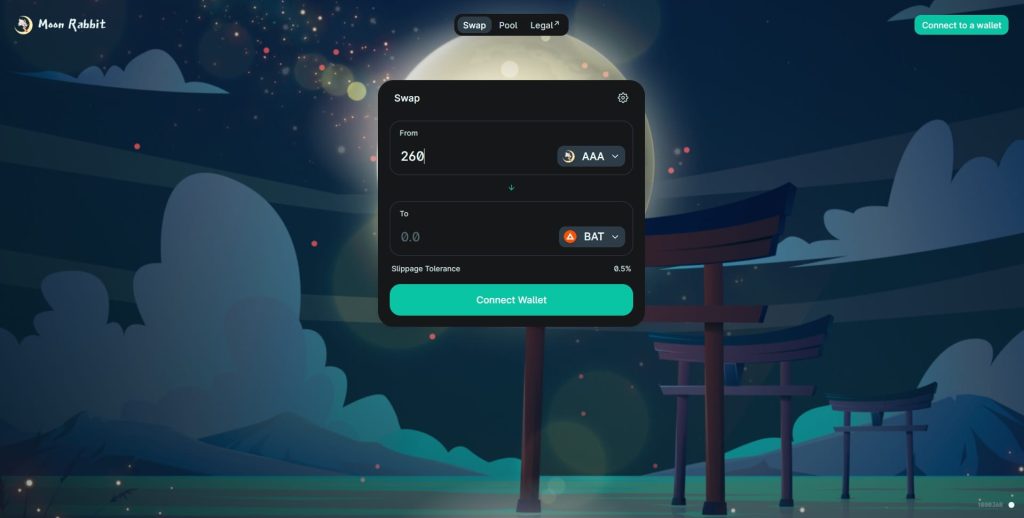

The memecoin market is booming, and Moon Rabbit has been prepared for this moment since the early days. Our infrastructure was built with native smart contract support, making it an ideal environment for launching and managing new tokens.

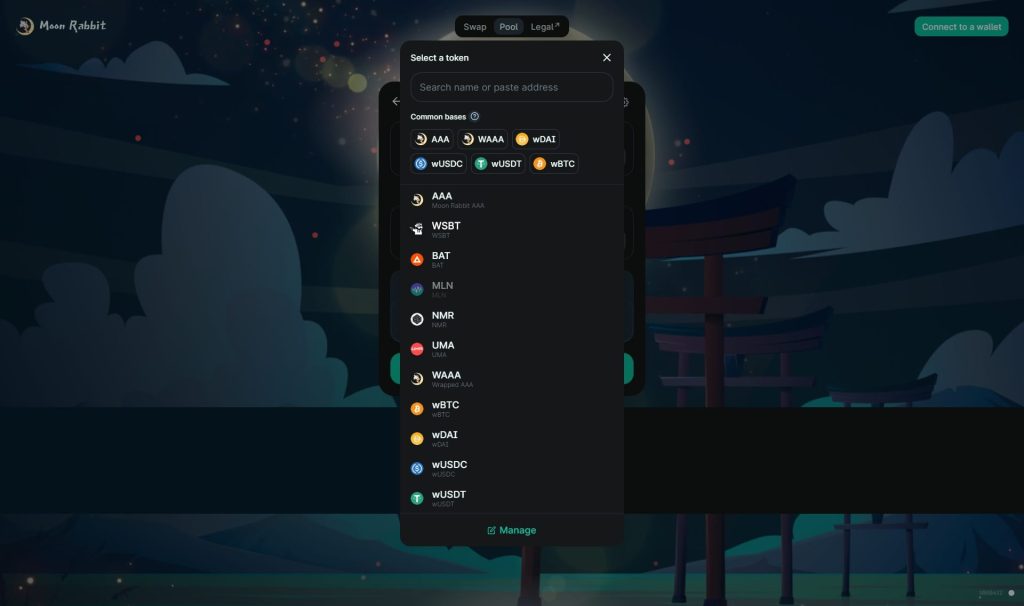

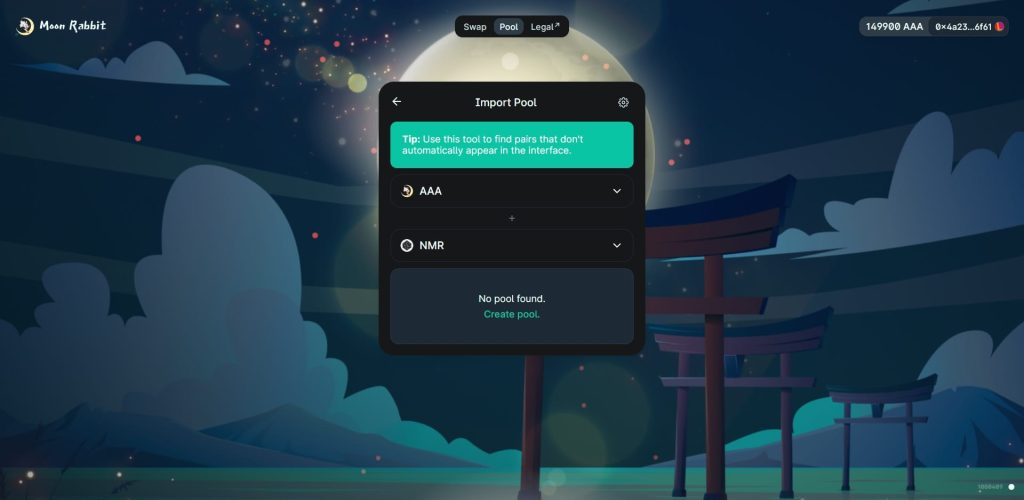

In 2025, we will introduce a dedicated memecoin launch platform, allowing creators and communities to easily deploy, customize, and list their tokens on Moon Rabbit EVM.

Key Features of the Memecoin launcher:

- No-code token launch – Users will be able to create and deploy a memecoin with just a few clicks.

- Pre-set or customizable tokenomics – Choose between standard token models or set unique parameters.

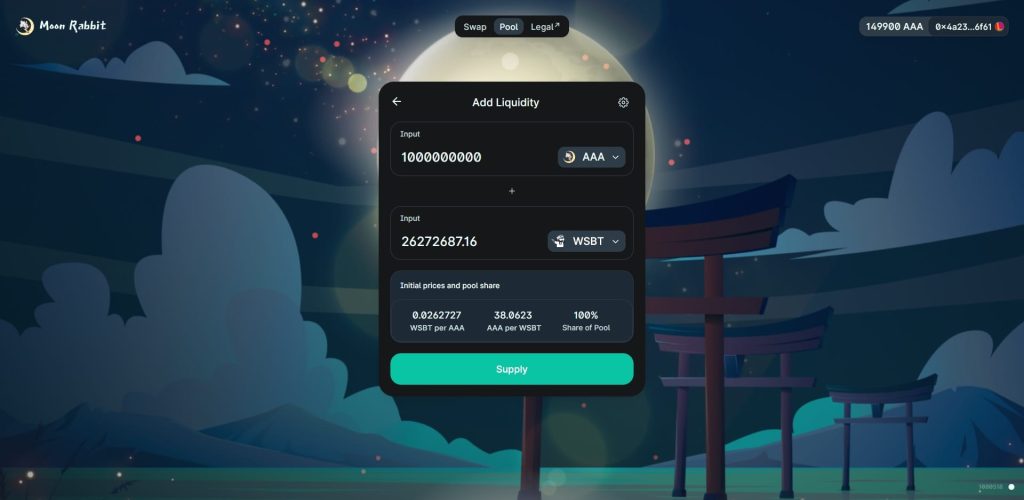

- Integrated liquidity tools – Ensuring newly launched tokens have the necessary liquidity for trading.

- Community-friendly mechanisms – Built-in staking and governance options for memecoin projects.

This feature will empower creators, providing them with a simple yet powerful environment to launch viral tokens while leveraging Moon Rabbit’s low fees and high-speed transactions.

Bullish on BNB Chain: A Strong Signal for Altcoins

At Moon Rabbit, we recognize the growing strength and potential of the BNB Chain, which continues to establish itself as a dominant force in the crypto space. With its high-speed, low-cost transactions, strong developer community, and expanding DeFi ecosystem, BNB Chain has positioned itself as a leader in altcoin adoption. Given this momentum, we are excited that Moon Rabbit’s AAA coin is already available on BNB Chain, further increasing its accessibility and liquidity. This alignment with one of the most robust EVM blockchains is a bullish signal for altcoins, reinforcing our confidence in the future of multi-chain ecosystems and cross-chain growth. As we continue to expand, we see great opportunities for interoperability and strategic integrations between Moon Rabbit and BNB Chain, ensuring even greater adoption and utility for AAA and our broader ecosystem.

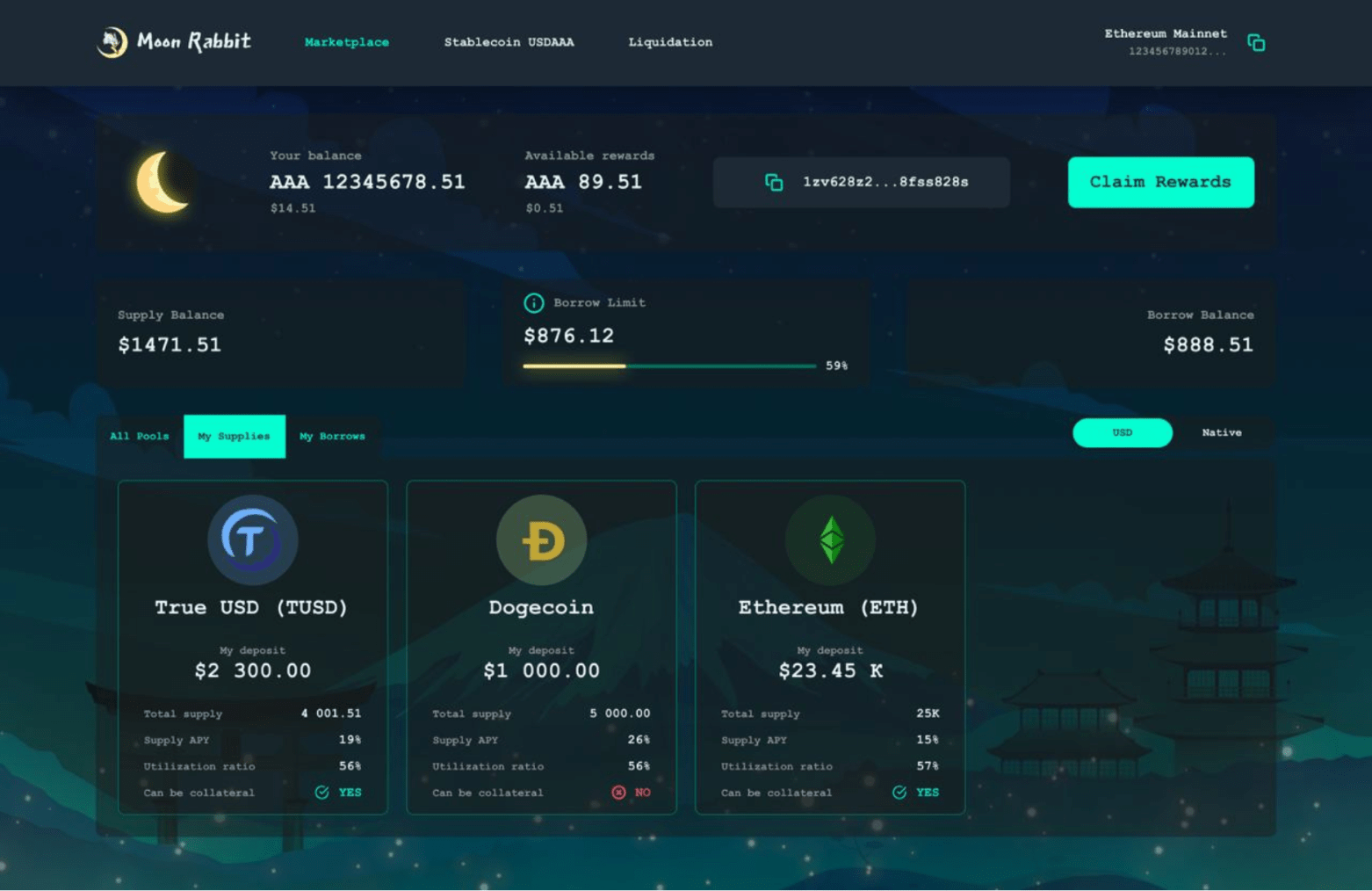

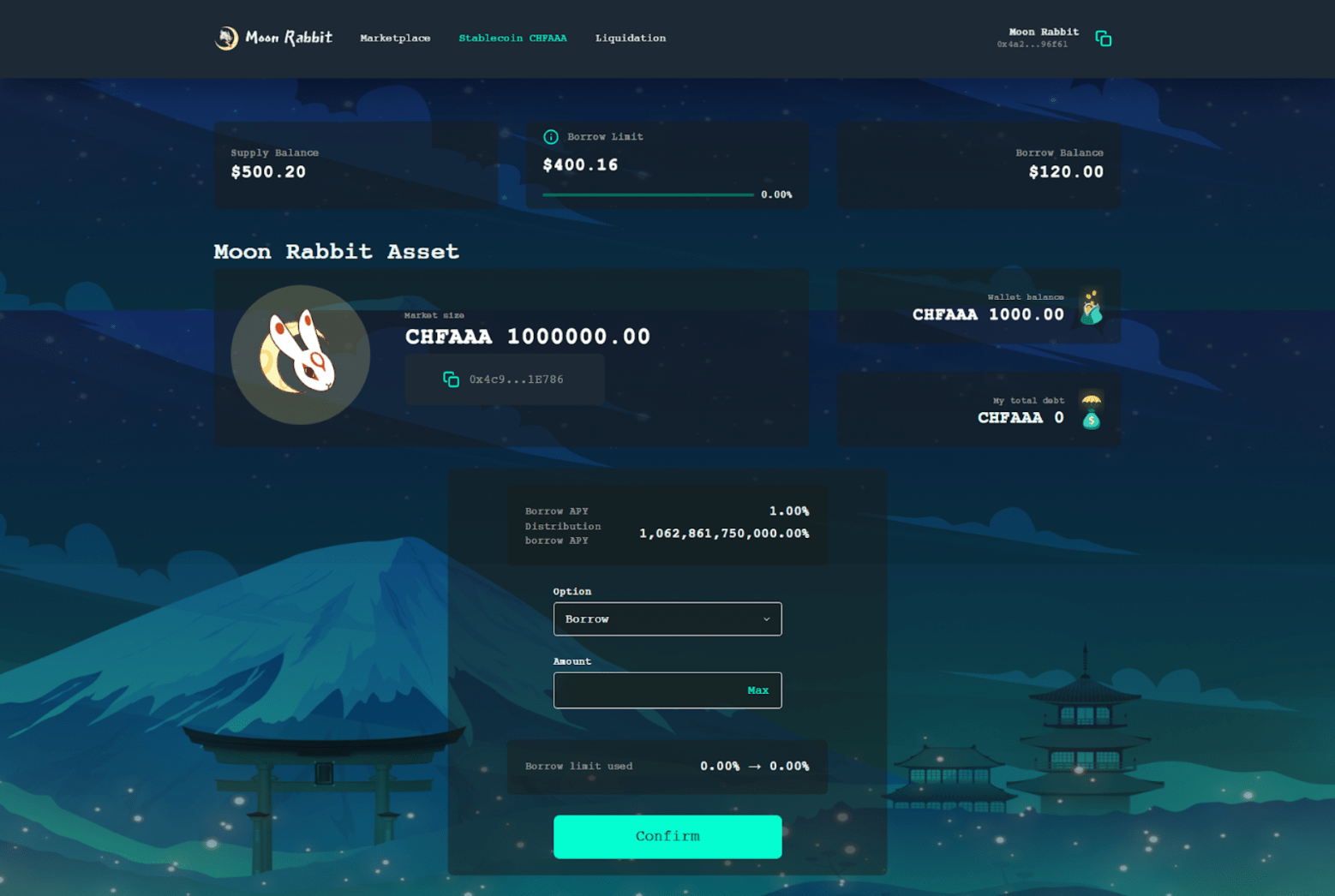

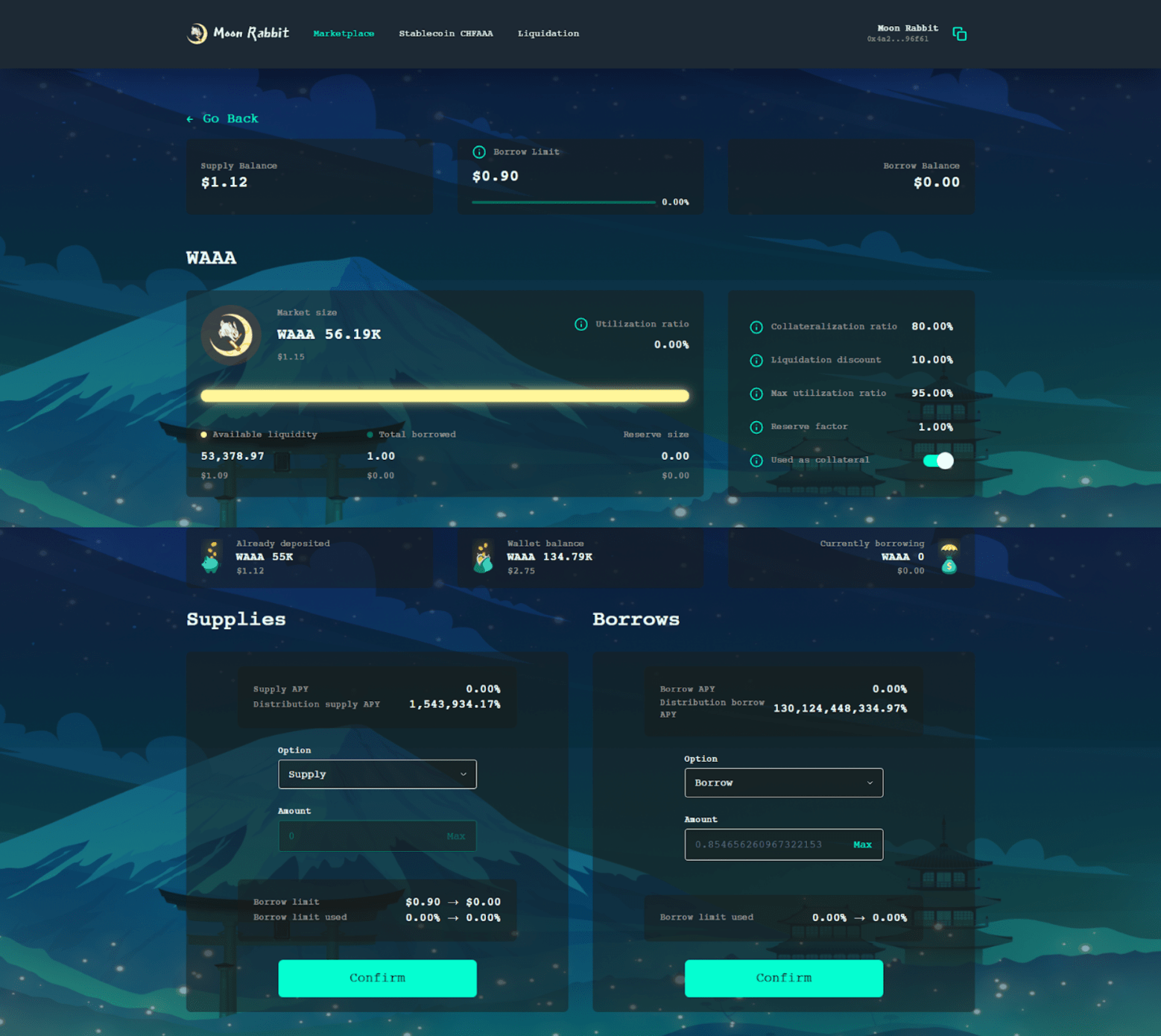

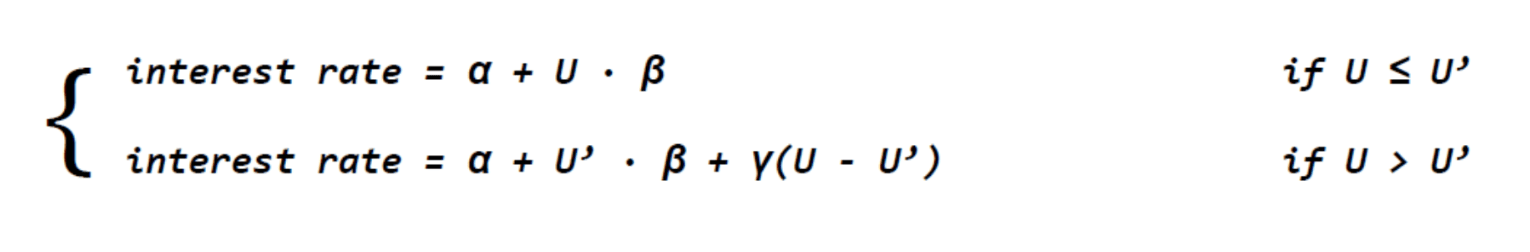

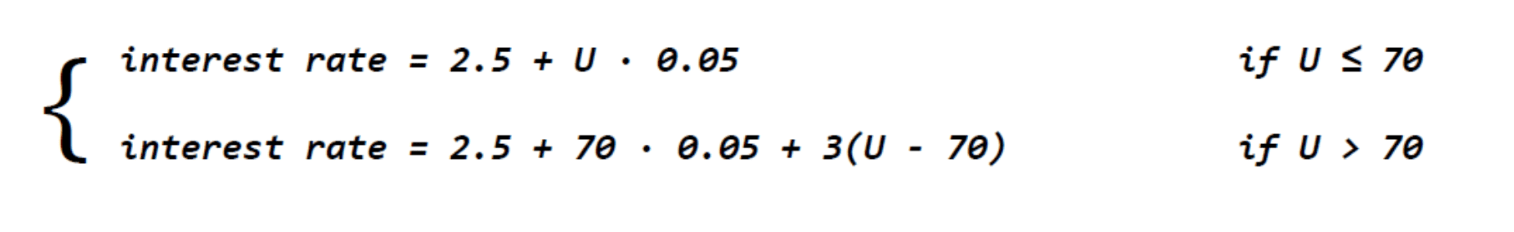

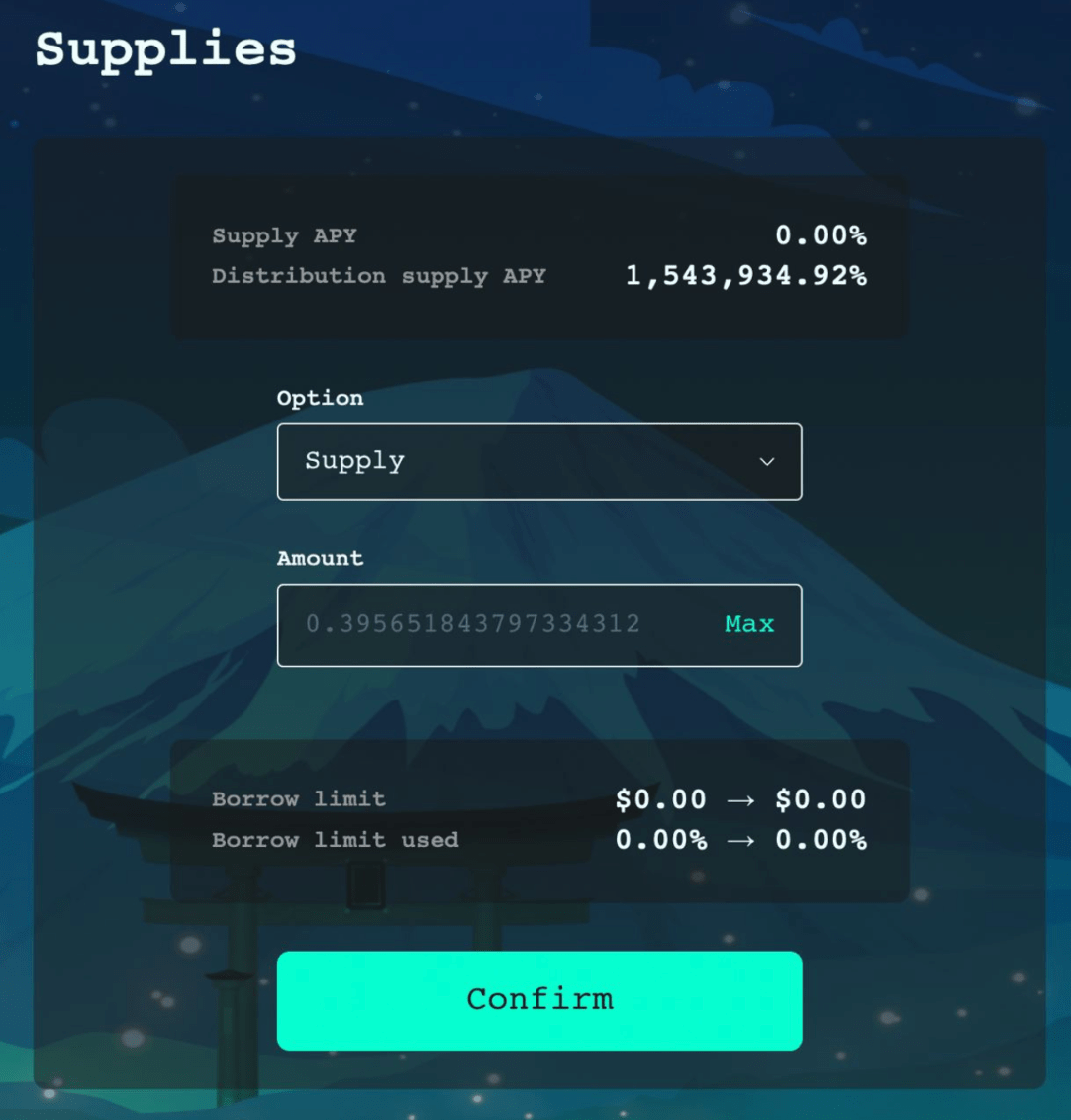

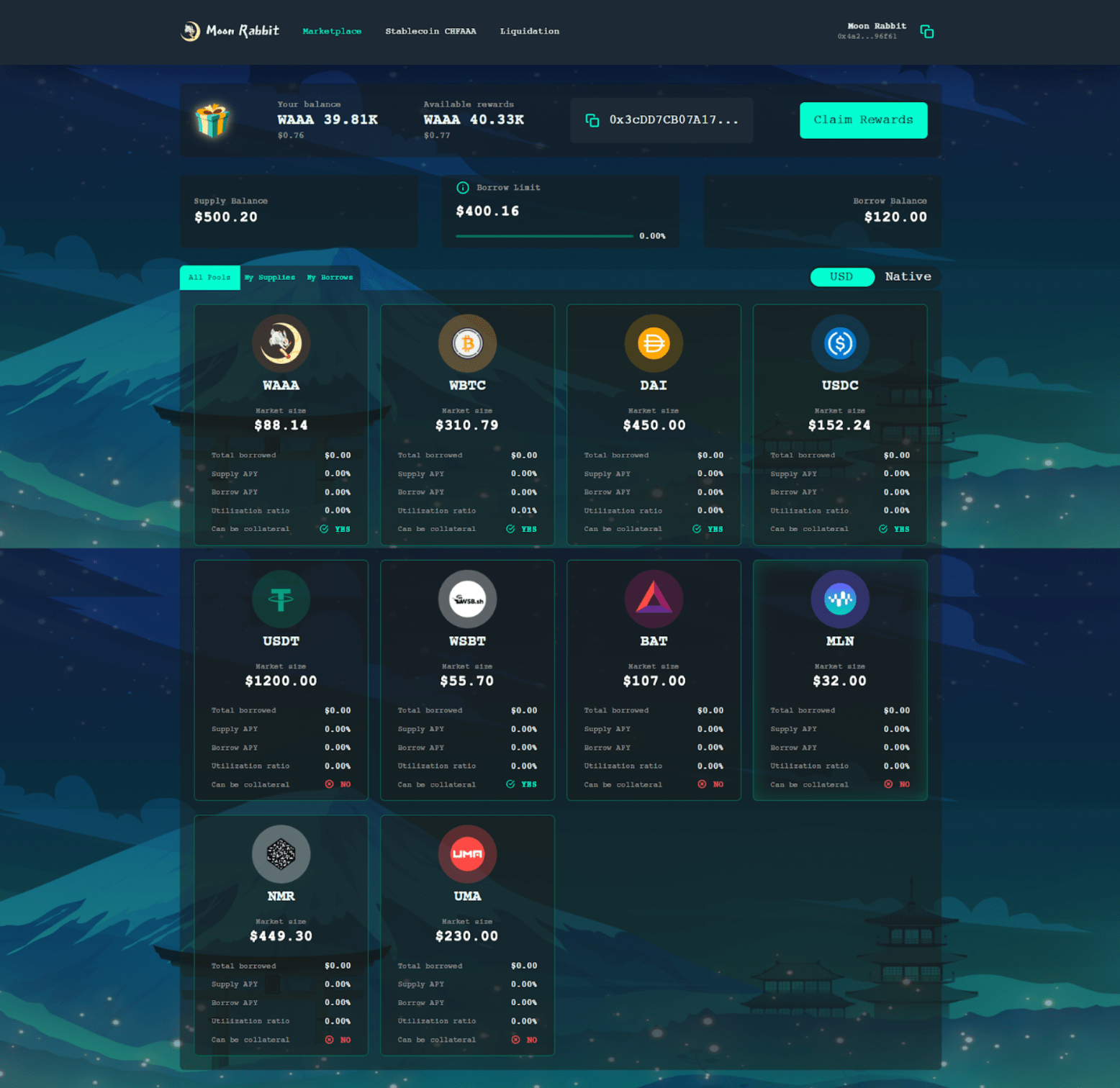

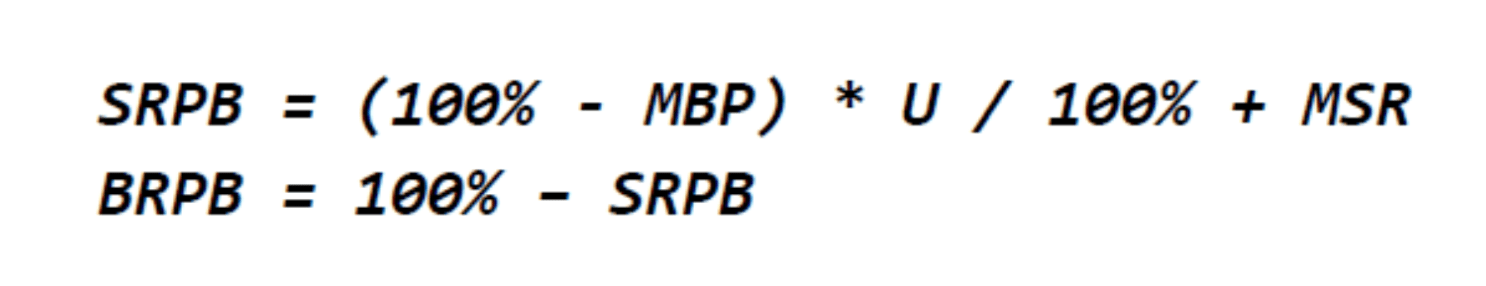

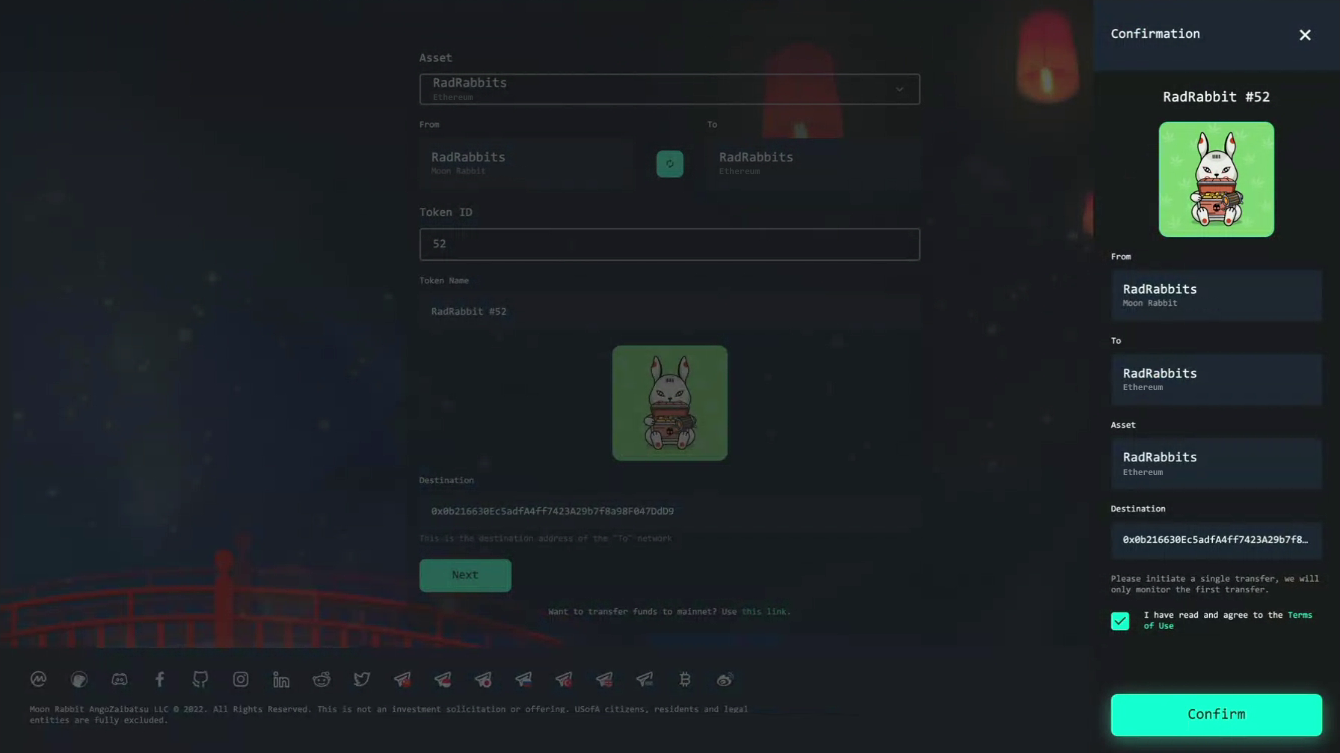

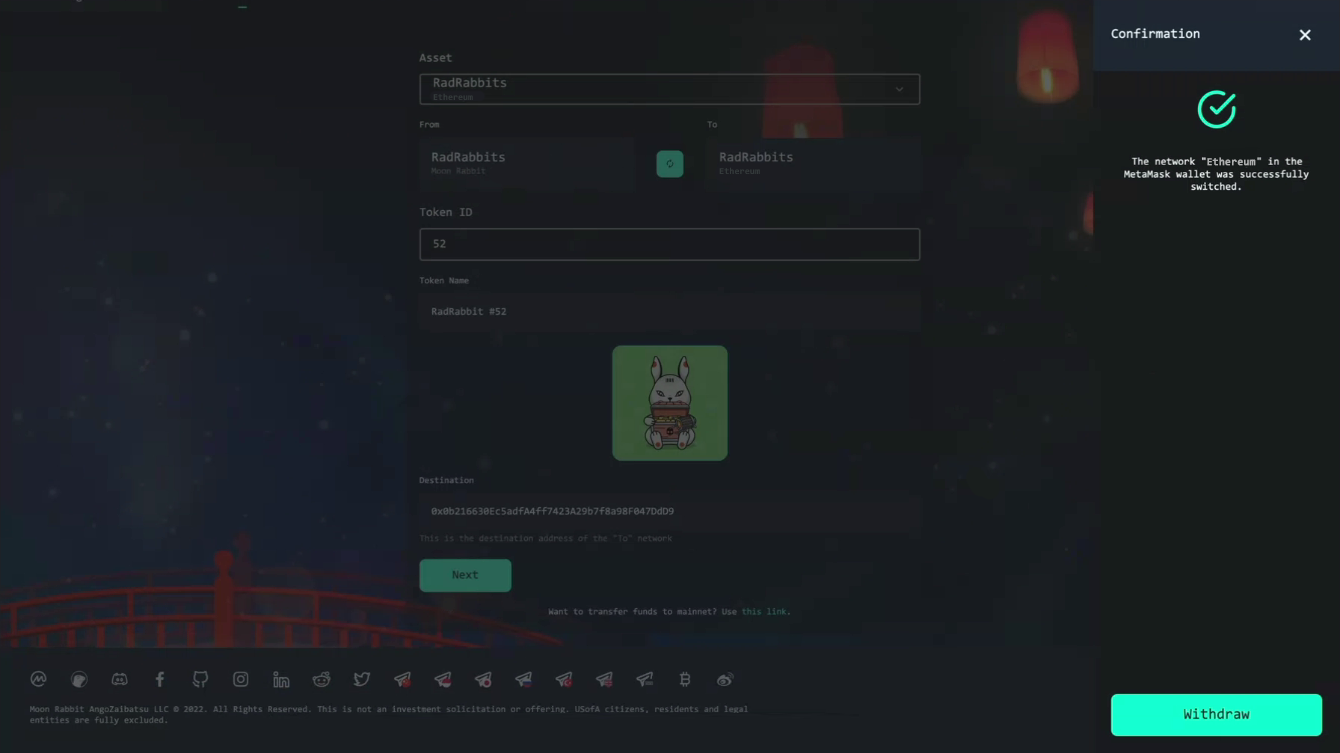

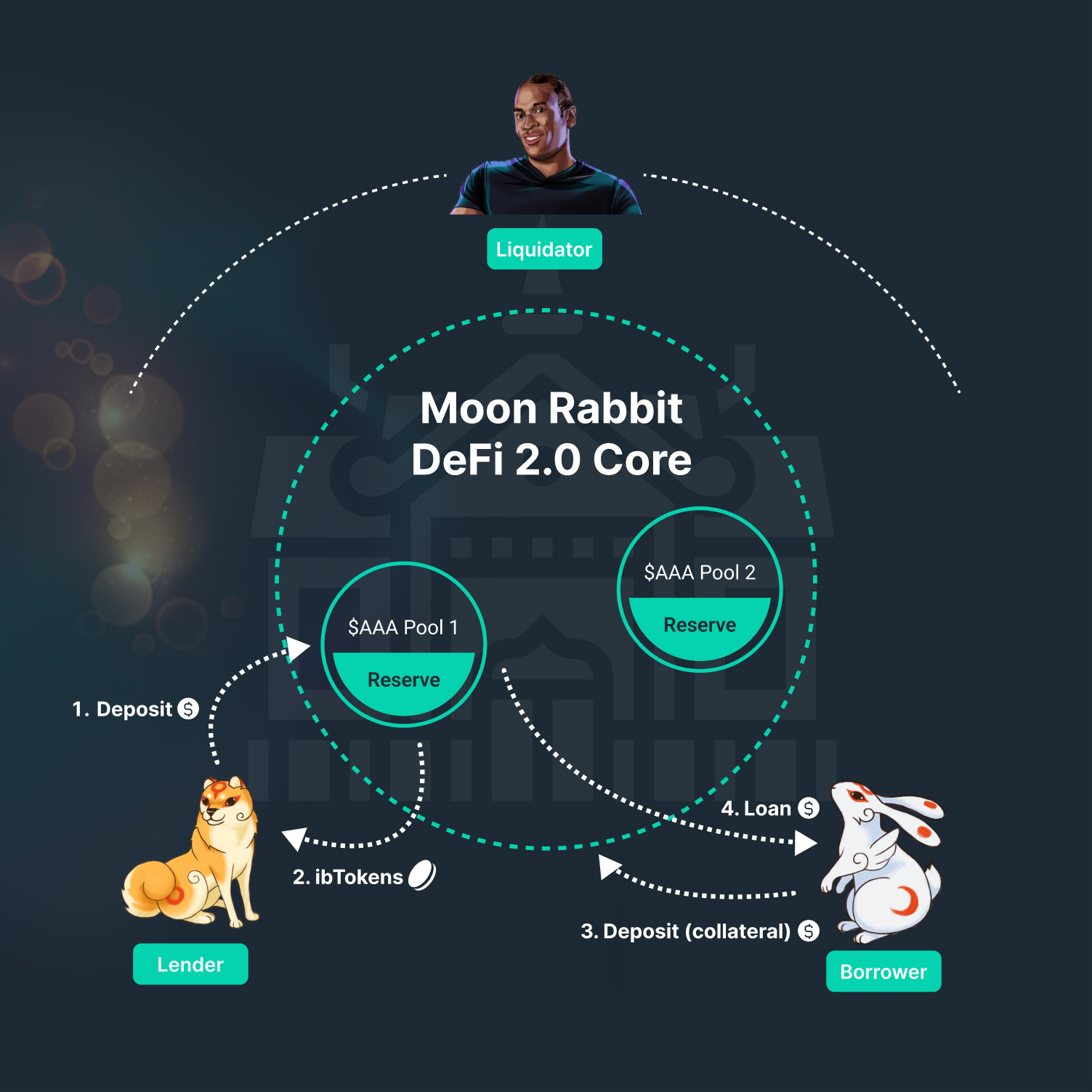

Incentivizing AAA DeFi Participation and Cross-Chain Bridging

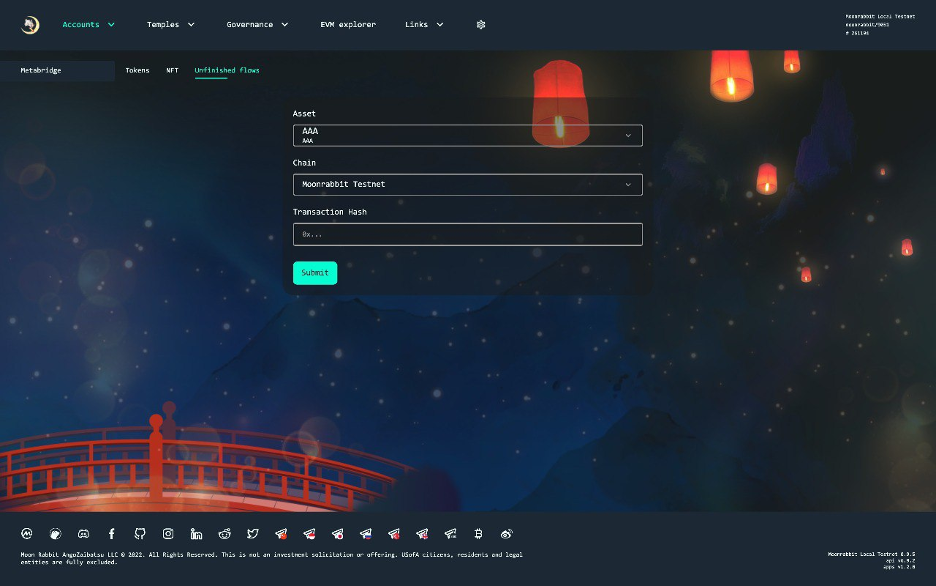

To further strengthen the AAA ecosystem and encourage deeper liquidity within our native EVM, we are introducing a rewards program for users who supply AAA in DeFi and utilize the Metabridge. This initiative is designed to incentivize cross-chain movement and boost engagement with Moon Rabbit’s infrastructure.

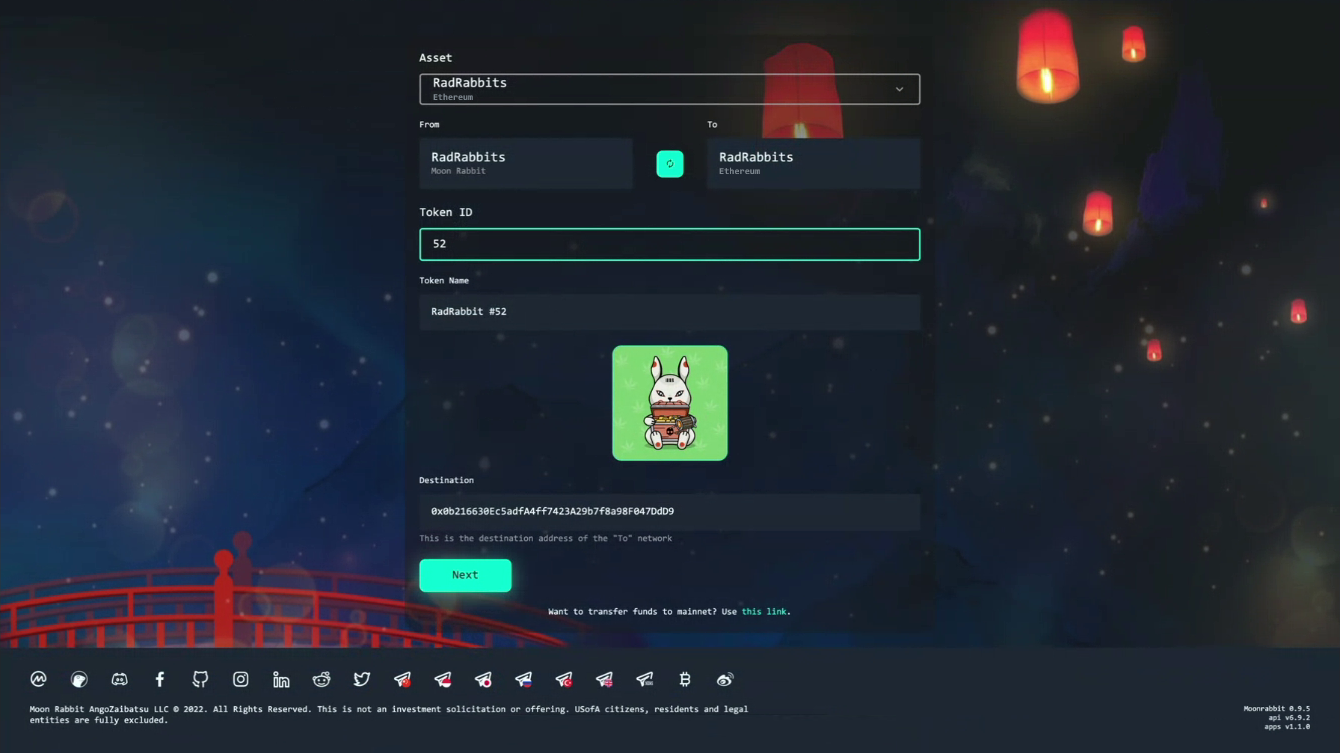

Users who bridge AAA from BNB, Ethereum, or Polygon to Moon Rabbit EVM will receive exclusive AAA rewards, creating a more interconnected and liquid ecosystem. This not only helps expand AAA’s presence across multiple chains but also reinforces Moon Rabbit EVM as a thriving hub for DeFi participation.

This is just the beginning—further details on reward distribution and participation mechanics will be announced soon. Stay tuned for more information as we roll out this exciting opportunity for the community!

The Future is Bright for Moon Rabbit

The 2025 roadmap marks a pivotal year for Moon Rabbit. With the Polkadot core and EVM upgrades, ChainID fix, major infrastructure improvements, and the introduction of a dedicated memecoin platform, Moon Rabbit is reinforcing its position as a leading blockchain ecosystem.

We remain committed to innovation, user experience, and community empowerment. Stay tuned for further updates as we continue to push the boundaries of what’s possible in decentralized technology.

Let’s make 2025 a milestone year for Moon Rabbit! 🚀